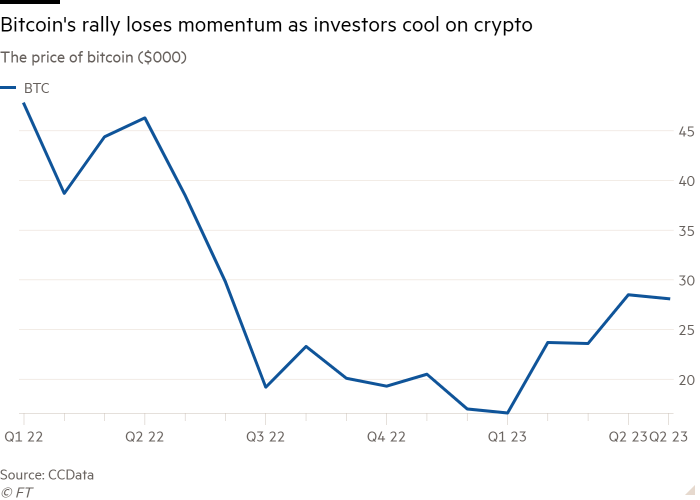

Cryptocurrency trading activity has eased even as bitcoin hit its longest winning streak in more than two years, suggesting many investors are increasingly reluctant to buy into a rally following a series of crashes and scandals in 2022.

The price of bitcoin, the most popular coin, has risen 70 percent this year, helping the market regain momentum after the collapse of firms such as exchange FTX.

Investors shrugged off lawsuits by U.S. regulators against companies including the industry’s largest exchange Binance and collapsed stablecoin operator Terraform Labs, as authorities sought to clamp down on activities they deemed illegal.

However, the price of bitcoin has remained low for more than a month since then, trading in a tight range around $28,000. This pause is accompanied by a reduction in transaction volume, with small transactions increasingly able to influence market prices.

“While bitcoin’s recent performance looks good on paper, many in crypto are calling this year an unwelcome rally,” said Charles Story, head of growth at crypto index provider Phuture.

“Market sentiment hasn’t changed, and regulatory scrutiny is excluding a lot of new money that could come into the space. If the industry doesn’t make meaningful progress in regaining trust and attracting new investors, price action won’t mean much,” he added .

Setbacks in 2022 left investors losing money or stranded funds as failed cryptocurrency lenders and exchanges went through bankruptcy proceedings in court.

Cryptocurrency enthusiasts also believe that weakness in the global banking sector and large deposit outflows from banks such as Silicon Valley Bank and Silvergate Bank and Credit Suisse have rekindled confidence.

Digital Asset Dashboard

click here Get real-time data on cryptocurrency prices and insights

“The rebound we experienced after the banking crisis earlier this year seems to be directly related to the safety and self-regulation of funds fleeing the dollar,” said Edmond Goh, head of trading at cryptocurrency broker B2C2.

But that sentiment has been marred by a flood of signals from the crypto market. Analysts noted that the rise in cryptocurrency prices has been built on thinly traded markets.

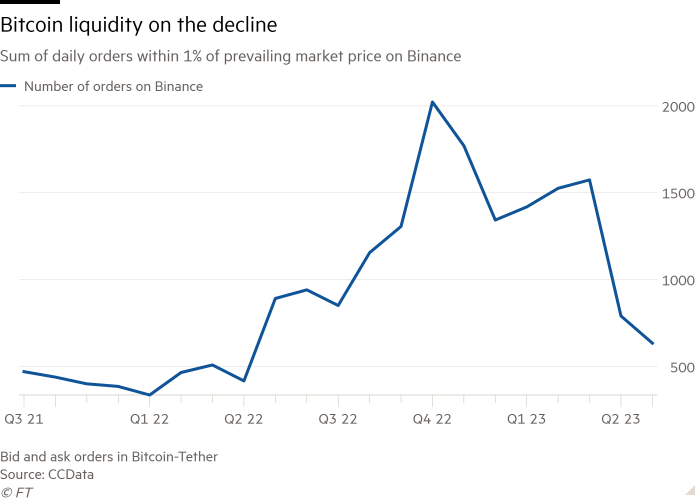

According to data provider CCData, the market’s ability to absorb large orders without major changes in bitcoin’s price has declined since the start of the year.

In January, CCData said it needed to buy more than 1,400 bitcoins, roughly equivalent to $23 million at the time, to increase the price of the token by more than 1% of its current market value.

By the end of last month, only 462 bitcoins (worth about $13 million) were needed to move the market price up 1%, the lowest point of market depth for the bitcoin-tether trading pair since May 2022, when the industry was in turmoil Dilemma crisis.

“Prices are recovering, but liquidity has not yet returned. There is no exchange or market maker that has yet to fill the space that FTX and (its sister trading arm) Alameda once occupied,” said Michael Safai, managing partner at cryptocurrency trading firm Dexterity Capital. . “

Investors who bought bitcoin in recent months are now holding onto their investments.

Investors who bought bitcoin when it hit a two-year low after FTX’s failure last November were “spending very little,” according to crypto data provider Glassnode.

“While the cryptocurrency market has risen sharply this year, the ‘fear of missing out’ that drove many first-time institutional and retail investors last year is clearly not happening now,” said a Dubai-based cryptocurrency fund manager, referring to a Fear of missing out.

Additionally, digital asset investments have seen $72 million in outflows over the past two weeks, ending a six-week streak of inflows, according to CoinShares. The crypto investment group attributed the trend to the possibility of further rate hikes by the Federal Reserve.

Traders are also concerned that the cloud that has hung over the sector over the past 12 months has not completely lifted. Binance, the world’s largest cryptocurrency exchange, could be embroiled in a protracted lawsuit with the U.S. Securities and Exchange Commission.

Another cloud is the fate of Genesis, one of the largest lenders in the cryptocurrency market, which filed for bankruptcy in January after the FTX debacle, owing more than $3 billion.

Owner Digital Currency Group, one of the world’s largest bitcoin owners, through its asset management arm, is seeking to raise funds to repay Genesis creditors. DCG says last week Some Genesis creditors have abandoned a previously negotiated restructuring agreement.

Ram Ahluwalia, chief executive of investment adviser Lumida Wealth Management, said the market appears to be “in hold mode waiting to resolve DCG debt payments”.

Uncertainty and the crisis in the U.S. regional banking sector have shown to many that markets are still grappling with many issues.

“There’s still not a lot of organic momentum behind cryptocurrencies,” Safai said. “Headlines that push cryptocurrency prices past pivotal points . . are few and far between.”`

Click here Visit the Digital Assets Dashboard