Swiss authorities facilitated UBS’s controversial 3 billion Swiss franc ($3.37 billion) bailout of Credit Suisse over a weekend in March.

Fabrice Coferini | AFP | Getty Images

Swiss bank Its emergency receivership is estimated to have caused approximately $17 billion in financial losses credit suisseaccording to a regulatory filing, and said the rushed deal may have affected its due diligence.

In a new filing with the U.S. Securities and Exchange Commission (SEC) late Tuesday night, the Swiss banking giant said the total negative impact from fair value adjustments to the new combined entity’s assets and liabilities would be about $13 billion, The potential impact is $4 billion hit by litigation and regulatory costs.

However, UBS also expects to offset this with a one-off gain of $34.8 billion from so-called “negative goodwill”, which refers to acquiring assets at a cost far below their true value.

Credit Suisse was on the brink of collapse after Swiss authorities brokered a 3 billion Swiss franc ($3.4 billion) emergency takeover of its struggling domestic rival over a March weekend, amid a flood of client withdrawals and a plunge in shares price.

In the amended F-4, UBS also highlighted the short period of time it was forced to conduct due diligence, which may have affected its ability to “comprehensively evaluate Credit Suisse’s assets and liabilities” before the acquisition.

The document shows that Swiss government authorities approached UBS on March 15 while considering whether to start selling Credit Suisse “in order to stabilize the market and avoid the possibility of contagion in the financial system”. The bank has until March 19 to conduct due diligence and make a decision.

UBS said: “If the due diligence situation affected UBS’s ability to fully consider Credit Suisse’s liabilities and weaknesses, UBS may agree to a rescue operation that is much more difficult and risky than it anticipated.” Risk Factors section of the document.

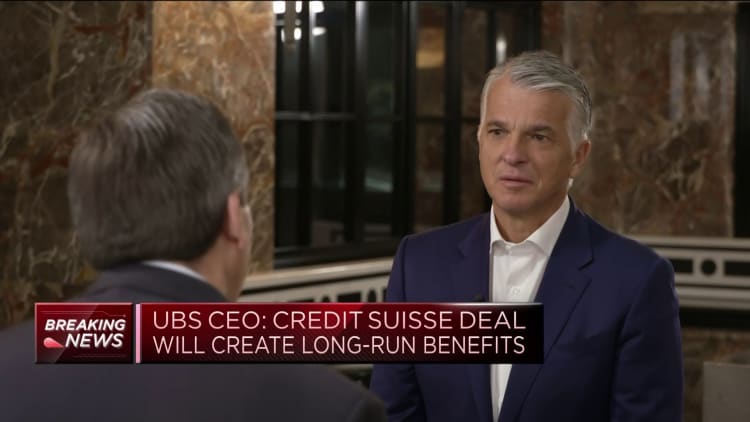

While this was highlighted as a potential risk, UBS Chief Executive Sergio Ermoti told CNBC last month that the Credit Suisse deal was risk-free and would create long-term benefits.

The most contentious aspect of the deal was regulator FINMA’s decision to cancel some $17 billion of Credit Suisse’s Additional Tier 1 (AT1) bonds before taking a stake, which violated the traditional order of writedowns and led to legal action by AT1 bondholders .

UBS’s strategy committee began reviewing Credit Suisse in October 2022 because of the deteriorating financial conditions of its rivals, according to filings on Tuesday. The long-struggling bank experienced massive net asset outflows in late 2022 due to liquidity concerns.

UBS’ strategy committee concluded in February that buying Credit Suisse was “not advisable” and the bank continues to analyze the financial and legal implications of such a deal in case the situation deteriorates to the point where Swiss authorities demand UBS step in.

UBS announced last week that Credit Suisse CEO Ulrich Koerner will join the executive board of the new combined entity once the deal is legally completed, which is expected to be completed in the next few weeks.

The group will operate as a “universal banking group”, with Credit Suisse maintaining its brand independence for the foreseeable future as UBS undergoes a phased integration.