Tech stocks are listed on Nasdaq.

Peter Kramer | CNBC

Portfolio manager Freddie Lait said the market’s love for big tech stocks this year has been “short-sighted,” saying the next bull market phase will expand to other sectors that offer greater value.

So far in 2023, the stock prices of the US tech giants have been rising. apple Shares closed Wednesday up nearly 33% year-to-date, while Google parent company letter up 37%, amazon 37.5% higher and Microsoft up 31%.facebook parent Yuan Its shares have soared more than 101% since the beginning of the year.

This small group of companies is very different from the broader market, Dow Jones Industrial Average Growth of less than 1% by 2023.

The gap between big tech companies and the broader market widened after the earnings season, with 75% of tech companies beating expectations, while the picture in other sectors was mixed, with generally downbeat economic data.

Investors are also betting on a further rally as central banks begin to slow and eventually reverse aggressive monetary tightening rmost recent time. Big tech companies outperformed the broader market for years during periods of low interest rates before getting a major boost from the Covid-19 pandemic.

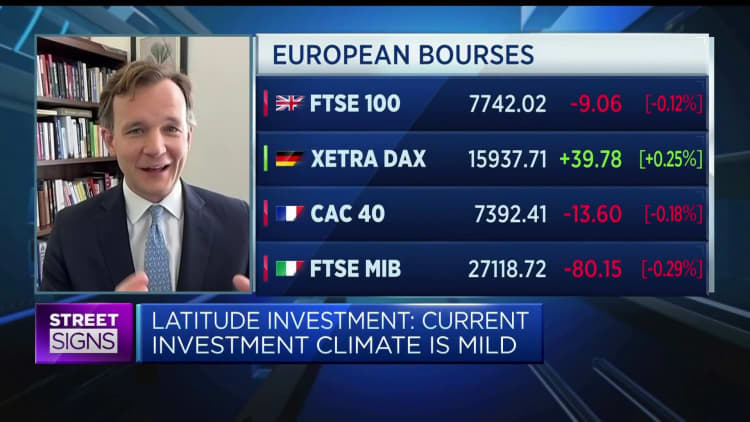

Yet Lait, managing partner at Latitude Investment Management, told CNBC’s “European Street Signs” on Wednesday that while the market’s positioning is “rational” in the circumstances, it’s also “very short-sighted.”

“I think we’re going to be in a very different cycle over the next two to five years, and while we may have a tricky period this year, with interest rates coming back up, people may be hiding back at the big tech companies, but I think the next leg of the bull market — whenever that comes — it’s going to be broader than what we saw in the last segment, which is really just some sort of tech and healthcare dominance,” Wright said.

“You have to start looking at some of these Dow Jones-type stocks — industrials or old economy stocks in a way — to find the deep value that you can find in other great growth companies, just different on the outside. department.”

Wright predicts that the widening valuation gap between tech and other markets will begin to narrow as market participants discover value in sectors other than tech over the next six to 12 months.

However, given Silicon Valley’s strong earnings trajectory in the first quarter, he thinks it’s worth owning some tech stocks as part of a more diversified portfolio.

“We also own some of these tech stocks, but I think there is a real concentration risk in a portfolio that is fully exposed to these tech stocks,” he explained.

“What’s more interesting is that it’s missing out on a huge amount of opportunity that exists in the broader market: other businesses compounding at similar levels to tech stocks, trading at half or a third of their valuation, giving you more if this cycle Different means diversification and more exposure.”

Therefore, he advises investors not to be fully skeptical of technology stocks, but to consider the expansion of the rally and the “shrinking of the valuation gap” and “choose the opportunity to enter the market.”