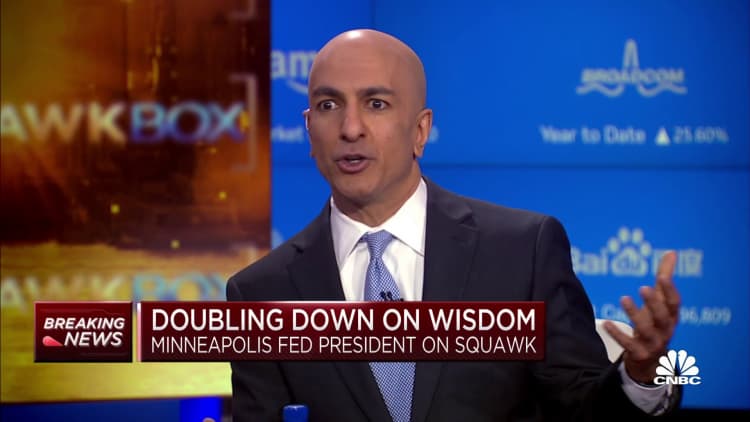

Minneapolis Fed President Neil Kashkari said on Monday he was open to delaying another rate hike next month, but cautioned against reading too much into the pause.

“Right now, either way, it’s a close call compared to another hike in June or skip it,” the central bank official said on CNBC’s “Squawk Box.” On to the skip. What matters to me is not the signal that we’re done. If we do, if we skip in June, that doesn’t mean we’re done with the tightening cycle. It means to me, we’re Get more information.”

Markets are currently pricing in about an 83% chance that the rate-setting Federal Open Market Committee will delay its 11th consecutive rate hike, based on its June 13-14 meeting. CME Group’s Fed Watch A tracker for futures prices. Kashkari is a voting member of this year’s FOMC.

Beyond that, traders see the Fed likely to cut interest rates by about half a percentage point by the end of the year, a nod to lower inflation and a slowing economy.

Central bankers have unanimously said they do not expect to cut rates this year. Kashkari said he would favor another rate hike if inflation did not fall.

“And then will we start raising money again in July? Possibly, so the most important thing to me is that we don’t take it off the table,” he said.

“The market seems to be very optimistic that interest rates will come down now. I think they believe that inflation will come down and then we will be able to respond to that. I hope they are right,” he added. “But no one should be confused by our commitment to bring inflation back down to 2 percent.”

Minneapolis Fed President Neil Kashkari on Tuesday reiterated the central bank’s commitment to keeping inflation in check through tighter monetary policy, saying his biggest concern was that the persistence of price pressures was underestimated.

Anjali Sundaram | CNBC

Federal Reserve Chairman Jerome Powell said on Friday that recent strains in the banking system could slow the economy enough to allow policymakers to be less aggressive.

Kashkari said that was possible, though he added that so far there has been little sign that recent banking problems have had a bigger impact on the macroeconomy.

“This is the most uncertain period we’ve ever been in in terms of understanding the underlying inflation dynamics. So I’ve had to let inflation guide me and I think we’re letting inflation guide us. Maybe we have to go north 6%” the federal funds rate, he said. “If banking stress starts to bring us lower inflation, then maybe … we’re getting closer to completion. I just don’t know right now.”

The Fed’s benchmark funds rate is currently set in a target range of 5% to 5.25%. As well as the rate decision, the June meeting will also update the central bank’s forecasts for inflation, GDP and unemployment, as well as a “dot plot” showing the governor’s future interest rate expectations.