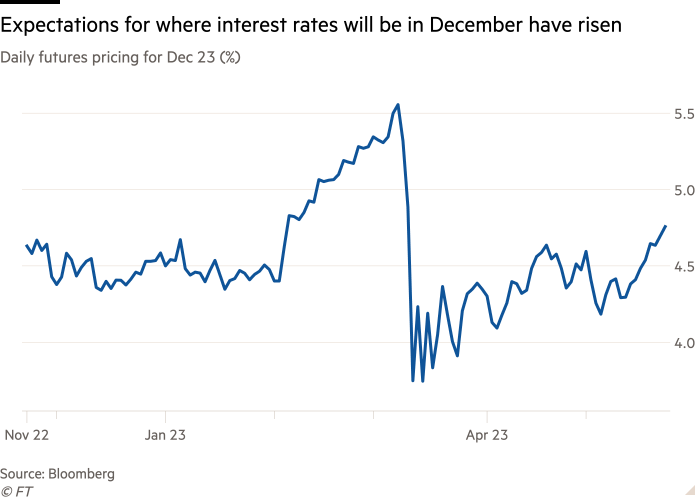

Bond traders engaged in a major rethink on the path of U.S. interest rates, reducing bets on a series of rate cuts after persistently high inflation data and strong economic data.

A little over two weeks ago, traders in the U.S. Treasury futures market were betting on the possibility that rates could drop to 4.2% by the end of the year from the current range of 5% to 5.25%, suggesting three or even four rate cuts. Now, the expected total has been reduced to a possible maximum of 2, bringing the rate down to 4.7%.

The broad shift puts investors more in line with the Fed’s consistent message that it has no plans to lower interest rates while inflation remains well above target. But it also highlights the high degree of uncertainty about where the market will go next.

“If you’re confused about the macro outlook, it’s important to realize you’re not alone,” wrote analyst Dario Perkins at TS Lombard in London.

“An Old Testament-style recession would resolve many tensions and bring clarity to the outlook. But I wouldn’t be surprised if this chaos persists for a while, as the global macro environment continues to frustrate bulls and bears alike.”

Since the collapse of Silicon Valley Bank and other regional U.S. banks this year, financial markets have been anticipating a credit crunch that would lead to a U.S. recession, which could prompt the Federal Reserve to cut interest rates.

Meanwhile, U.S. consumer price increases have been slowing, reaching an annual rate of 4.9% in April. Some investors believe that, along with the regional bank failures, is a sign that the Fed will begin to reverse the historically aggressive pace of rate hikes it has undertaken over the past 14 months.

But the Fed itself has never endorsed that view, and in recent weeks a growing number of policymakers have reminded traders that the battle with inflation is far from over. The US job market also remains strong, with the unemployment rate hovering at a 54-year low. A brief rise in weekly jobless claims in early May turned out to be largely due to Fraud, say the economist. The bond market is caught in these crossing currents.

“The data flow has been a little bit better lately. People are concerned (about) jobless claims . . . but then it turns out that there’s fraud in Massachusetts and we’re not trending that high, which is one of the reasons we’re unwinding some of the rate cuts,” Morgan said. said Jay Barry, head of interest rate strategy at Chase.

Barry also noted that the JPMorgan Surprise Index, which compares investors’ perceptions of economic growth with the reality in the data, has risen sharply in the past few weeks.

Federal Reserve Chairman Jay Powell said on Friday that an expected credit crunch following regional bank failures could limit how much the central bank can raise interest rates.

“The sooner we see the Fed stop raising rates, the less economic damage we see and therefore the less we need to cut rates,” said Kristina Hooper, chief global market strategist at Invesco.

This adjustment to the view on rate cuts could be important for asset managers, who have been buying short-dated bonds, betting that rates will fall. Yields on shorter-dated Treasuries move with inflation expectations, so higher yields could be costly.

“From now on, I think the level of uncertainty remains high and investors will remain extremely cautious given the tail risks ahead and the high volatility early in the year,” said Kavi Gupta, head of U.S. rates trading at Bank of America.

Investors also said recent progress in debt-ceiling talks could push yields higher.

“Typically, U.S. Treasuries rallied on fears the U.S. government would default on the dreaded debt-ceiling debate, so the bond sell-off and the fact that yields rose were driven at least in part by hopes and expectations,” said M&G Investments, chief investment officer for public fixed income. Officer Jim Leavis said on a podcast this week.

BlackRock analysts say investors are falling back into the habit of assuming that market stress or economic turmoil will prompt the Fed and other central banks to abandon interest rates.

“Most developed markets are grappling with a common problem. Core inflation has proven more persistent than expected and remains well above the central bank’s 2% target,” they wrote in a recent note.

“We take this to mean that the central bank cannot cancel any anti-inflationary rate hikes in the short term, even if financial markets think the Fed will start cutting rates by the end of the year. We see a recession coming. The economy is different, and we think unresolved inflation issues make this less likely.”