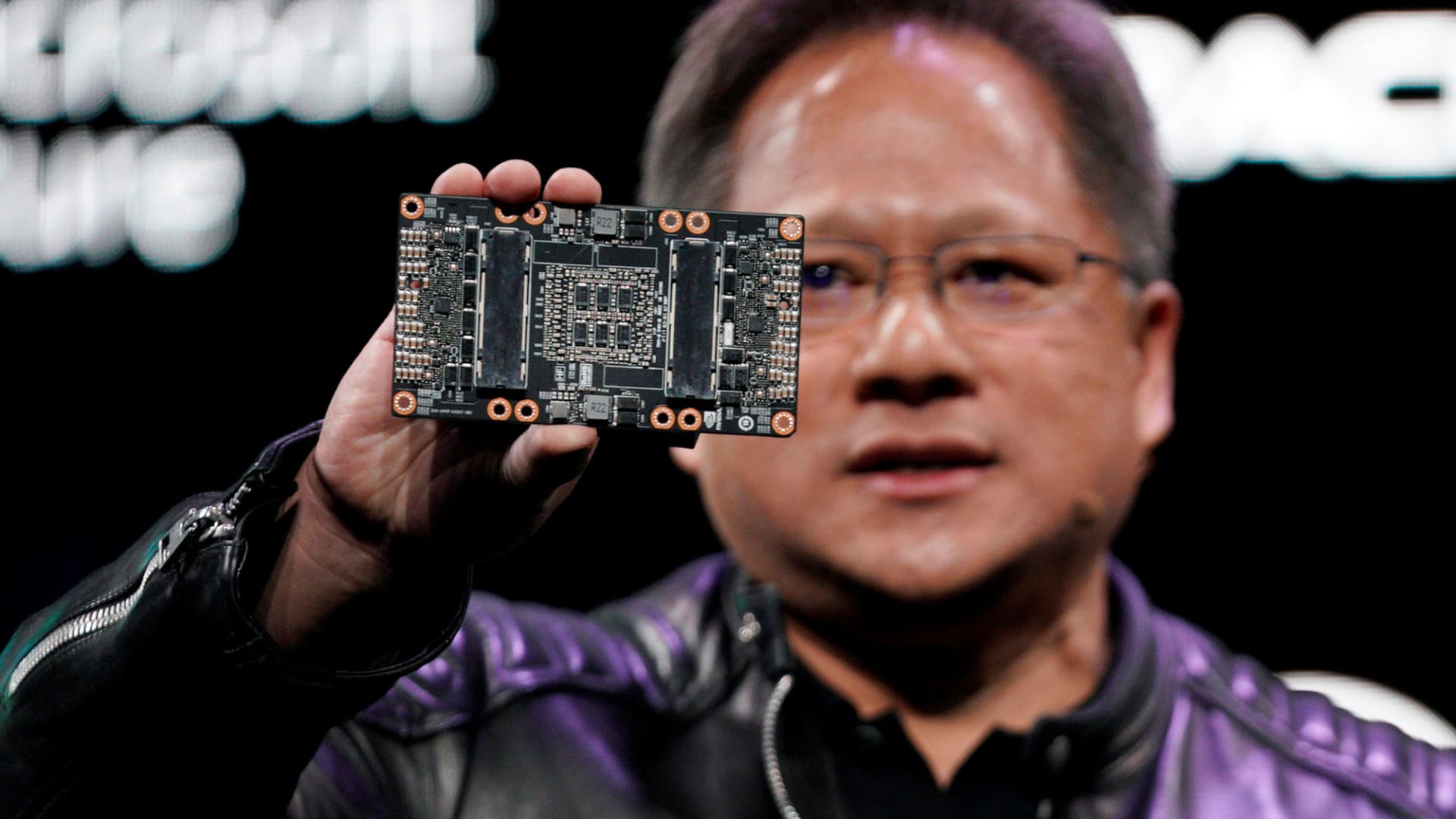

On January 7, 2018, Nvidia CEO Jensen Huang demonstrated the Nvidia Volta GPU computing platform during his keynote speech at CES in Las Vegas.

Rick Wilkin | Reuters

Nvidia’s In Thursday’s trading, earnings boosted some semiconductor companies, especially those specializing in chips for artificial intelligence, while pushing down shares of other chipmakers, including Intel and Qualcomm.

Nvidia stock jumps 25%, while Nvidia stock jumps a notable 9% Advanced Micro DevicesCompanyBoth Nvidia and AMD specialize in so-called discrete or discrete graphics processing units. Meanwhile, shares of traditional computer chip companies fell. Shares of Intel fell about 6 percent in early trade, while shares of Qualcomm, which makes mobile chipsets, fell about 1.3 percent.

The broad price action suggests a shift in focus from traditional computer chips to GPU makers. Enterprise demand for GPUs is surging as startups and established tech companies alike scramble to build artificial intelligence platforms. GPUs are the “brains” behind large language models and other AI techniques, helping to power OpenAI’s ChatGPT and Google’s Bard.

“You’re going to have fewer CPUs, not millions of CPUs, but they’re going to be connected to millions of GPUs,” Nvidia CEO Jensen Huang told CNBC.

Historically, the opposite has been the case. A potential inversion could drive a flight from CPU names to Intel and AMD.

TSMC shares also rose nearly 11%. TSMC is a key part of the manufacturing process for many semiconductor companies that design their own chips, but can be relied upon to handle delicate technical manufacturing processes.

Marvell and Broadcom, up 2% and 3%, respectively, benefiting from their exposure to cloud computing and potential AI applications. Companies that Marvell has partnered with include Google, Yuan and Microsoft; Broadcom has been developing technology to associate Artificial intelligence supercomputer together.

this VanEck Semiconductor Indexan ETF basket of chipmakers that include Nvidia and Intel, rose 6.4% in early trading Thursday.

Trading activity in Nvidia stock was also brisk Thursday. Just seven months ago, Nvidia closed at a two-year low of $112. But on Thursday, more than $15 billion worth of Nvidia stock changed hands, in addition to setting intraday all-time highs, as the company’s market capitalization approached $1 trillion.

In the first 18 minutes of trading on Thursday, the chipmaker’s shares had exceeded the full-day average volume.

— CNBC’s Kif Leswing and Robert Hum contributed to this report.