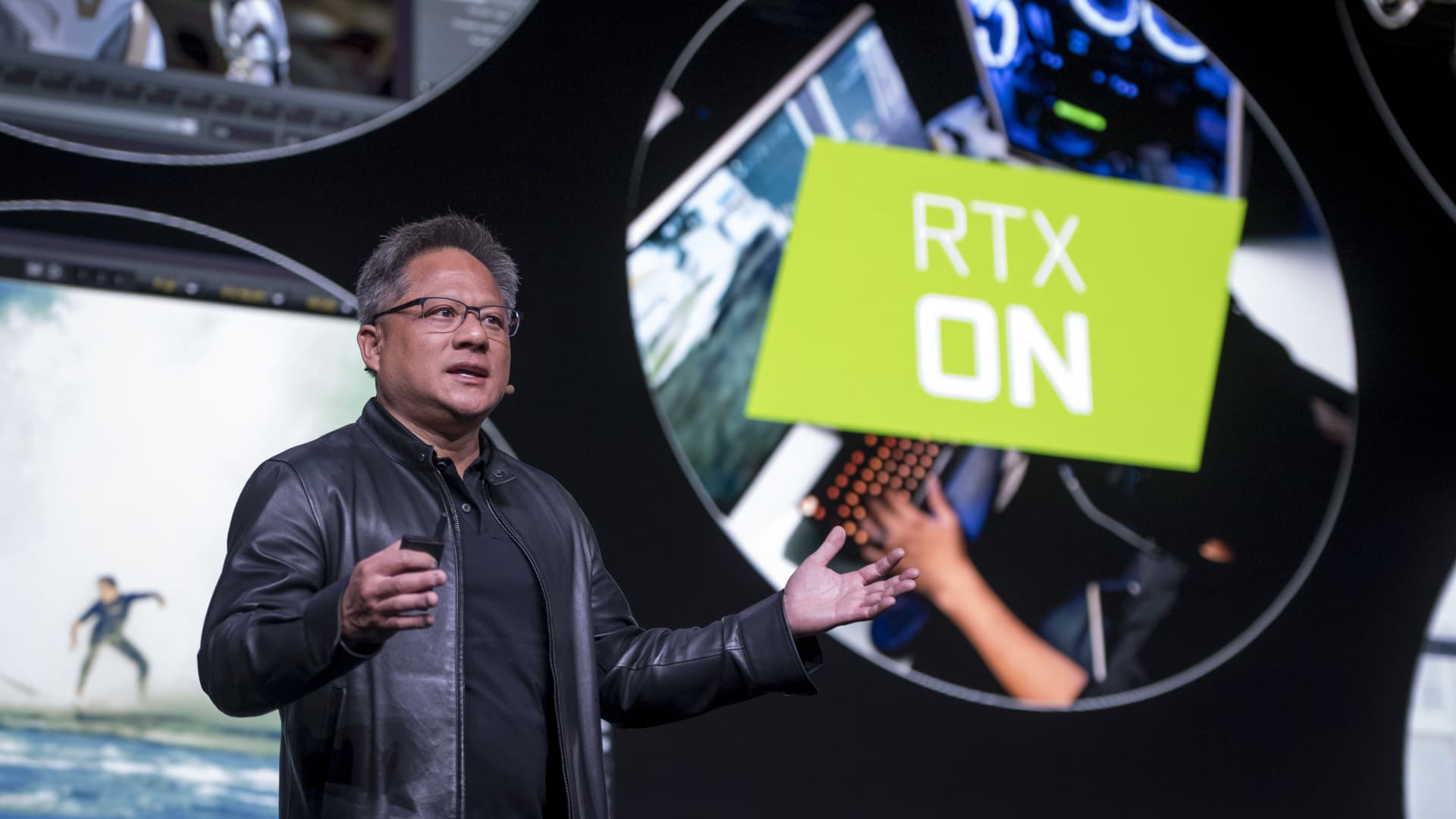

Nvidia President and CEO Jensen Huang speaks at the company’s event at CES 2019 in Las Vegas on January 6, 2019.

David Paul Morris | Bloomberg | Getty Images

shares Nvidia Shares jumped 25% on Wednesday, backed by an outsized earnings report that topped consensus estimates. And, if it stays the same throughout the session, they’ll close at an all-time high.

Nvidia’s all-time high came in November 2021, when the stock closed above $333. The stock opened at $385 on Thursday, giving up some of its overnight gains.

To put it in perspective, Nvidia’s shares have risen 235% since hitting a two-year low of $112 on Oct. 14, outpacing the performance of any other S&P 500 company since then. Meta was the second-best performing stock, up 97% over the same period.

The chipmaker’s market capitalization was on track to open at $975 billion after rising 30% in after-hours trading on Wednesday. The company reported first-quarter adjusted earnings per share of $1.09, compared with a Refinitiv consensus estimate of 92 cents. Its first-quarter revenue of $7.19 billion was well above the consensus estimate of $6.52 billion.

But it’s the chipmaker’s leading position as a supplier of AI chips, combined with $11 billion in sales for the period, that could send the stock soaring even higher.

Rising stock prices have pushed Nvidia’s valuation close to a trillion dollars, a mark that only a handful of publicly traded companies have ever achieved. apple The first valuation in 2018 was US$1 trillion, and it will reach US$3 trillion in 2022. letter, amazonSaudi Aramco, tesla, Yuan and Microsoft At one point it was valued at $1 trillion or more.

Analysts quickly raised their price targets for Nvidia following the company’s earnings report. JP Morgan raised its target price from $250 to $500 and reiterated its Overweight rating. “Generative AI and large language/translator models are driving accelerated growth in demand,” said JPMorgan analyst Harlan Sur.

“What else can we say but wow,” Evercore analyst CJ Muse wrote in a note Wednesday. Evercore raised its price target to $500 from $320 and reiterated its Outperform rating.

The skyrocketing valuation of Nvidia hasn’t boosted other chipmakers, however. The AI chip boom is driven by the need for high-performance graphics processing units, or GPUs.The company has been the historical leader in the high-performance “discrete” GPU market, especially with Intel.

Nvidia’s stock price has significantly outperformed that of Intel and AMD.

However, according to reports, Intel has been struggling to solve the inventory problem and recently implemented significant cost cuts, but whether it is Intel, or supermicro Has been able to achieve the same level of stock price growth as Nvidia. As of Wednesday’s close, Intel shares were up nearly 10% year-to-date; AMD shares were up 67% over the same period.

Nvidia stock had risen 109% year-to-date before rising after hours.

CNBC’s Michael Bloom and Kif Leswing contributed to this report.