India’s largest homegrown alternative investment manager is moving beyond real estate and distressed assets into private credit, hoping to get ahead of a wave of private capital and pension funds investing in the fast-growing economy.

Mumbai-based Kotak is the largest Indian player in the country’s nascent alternative asset management industry. After making a name for itself in the real estate fund space, it now sees some of the best opportunities to lend directly to companies.

“The nature of the opportunity now is going to be more M&A, growth-oriented financing,” said Srini Sriniwasan, managing director at Kotak Investment Advisors, which manages $8.8 billion. dollar assets.

Srinivasan added that there are also many opportunities for buying commercial real estate in India. While “the rest of the world sees office space and retail as unattractive, India has the opposite,” he said.

Alternative investments include a broad range of assets, including private equity, private debt, infrastructure, real estate, venture capital, growth capital and natural resources.

As India’s appetite for distressed assets grows, Srinivasan said alternative asset managers could also find opportunities in acquisition financing, an area where Indian banks and insurers have been less active.

Srinivasan said Kotak has secured $1.25 billion in funding for its second distressed asset fund, targeting a total of $1.6 billion, with investments from Singapore and Abu Dhabi sovereign wealth funds GIC and ADIA. The firm’s first distressed asset fund, launched in 2019, has returned 20% since launch.

Kotak has also raised a $500 million fund dedicated to investing in data centers, which it hopes will yield a 25% return, but has shelved plans to raise a start-up fund due to market volatility and plunging tech company valuations.

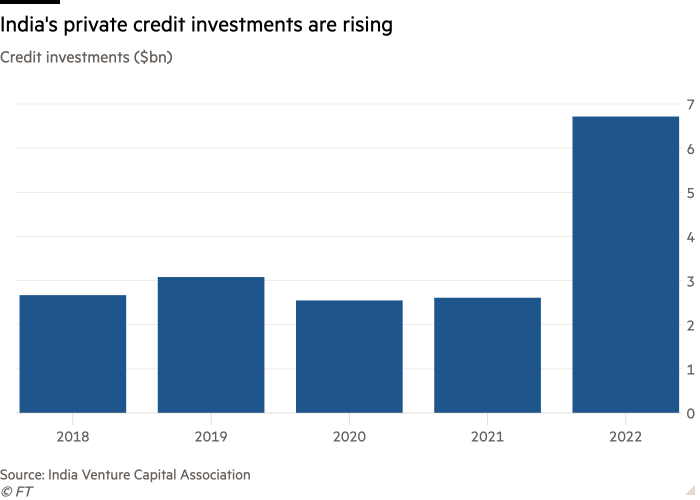

In India’s alternative asset management space, “private credit has seen the biggest growth,” said Rajat Tandon, president of the Indian Venture Capital and Alternative Capital Association.

“For investors, stock valuations have come down, while for companies it has become very expensive to borrow from banks. Private credit is a middle way between the two.

“Especially in India, where traditional lenders are cautious after various non-performing loan shocks, non-bank financial institutions are still recovering from the liquidity crisis,” Tandon added. “So private credit officers are taking this opportunity to bridge that gap.”

Srinivasan’s comments come as global groups are making inroads in India. Canada Pension Plan Investment Board opened its Mumbai office in 2015. Its recent investments in India include a $205 million investment in industrial property and warehouse developer IndoSpace’s latest real estate fund.

Meanwhile, global investor Brookfield recently invested more than $1 billion in Indian renewable energy group Avaada to fund its green hydrogen and green ammonia ventures.

Private credit investment will account for 12% of India’s total private equity and venture capital investments of $56 billion by 2022, up from 3% in 2021, according to EY data provided by IVCA.

Kotak’s growth comes after a string of foreign firms liquidated distressed funds in the country.

“When we raised our first (special situation) fund[in2019]Apollo was actually packaging their special situation fund,” Srinivasan said. “Lone Star is closing. Before that, WL Ross just finished a couple of years.”

Some companies are “too early in the game”, Srinivasan said, adding that it will take time for the benefits of India’s 2016 insolvency laws to emerge.

The new legal framework allows creditors to initiate bankruptcy proceedings against defaulting companies and allows courts to overturn company boards, paving the way for the sale of distressed assets.

“To be successful in India, you have to keep your feet on the ground,” Srinivasan added. “It’s not a market you’re trying to run through what I would call suitcase bankers from Hong Kong and Singapore. It might be a nice lifestyle for them, but it’s not going to pay off.”