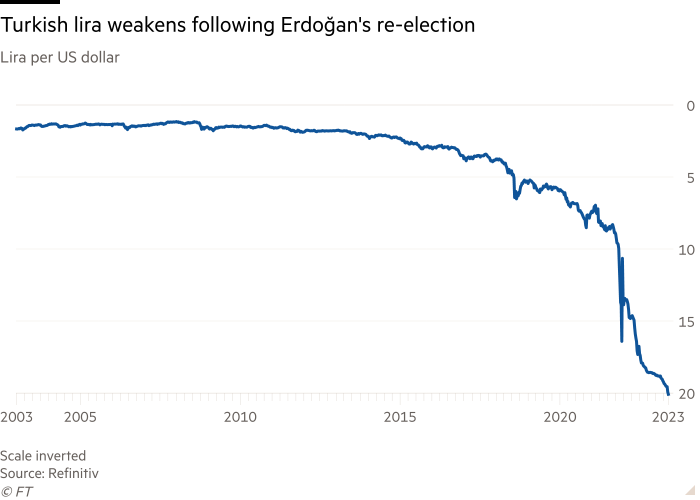

Turkey’s lira weakened following Recep Tayyip Erdogan’s re-election, with analysts warning that the winning president’s next big test will be tackling the country’s faltering $900 billion economy.

Many economists believe Erdogan’s policy of low interest rates and emergency measures to prop up the currency cannot continue. The lira hovered near record lows against the dollar on Monday after breaking above 20 Turkish lira late last week.

“The current policy stance has become unsustainable,” said Liam Peach at Capital Economics in London. “Turkey can no longer continue to maintain extremely low interest rates, very loose fiscal policy and deplete all kinds of foreign exchange reserves.”

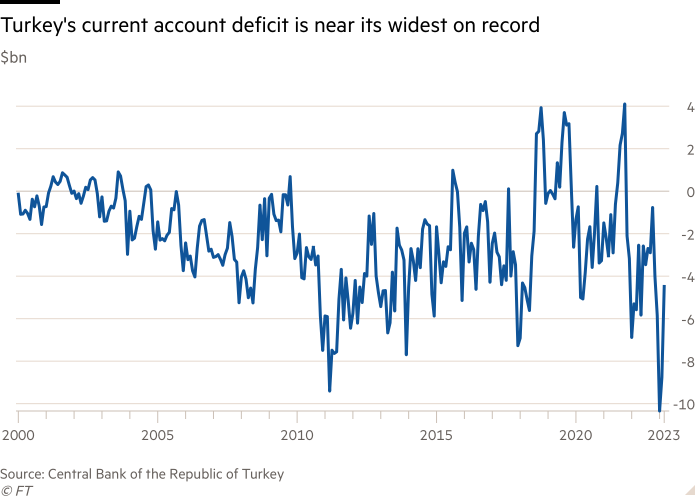

Turkey’s reserves have fallen by about $27 billion this year as the country tries to prop up the lira and fund a near-record current account deficit.

Reserves, including foreign exchange and gold, stood at just over $101 billion, official data showed.

However, according to JPMorgan, the net provision after deducting liabilities is effectively zero, and if the tens of billions of dollars borrowed from the local banking system are not included, the net provision is negative.

Clemens Graff, an economist at Goldman Sachs in London, said reserves are now “close to the levels seen before when lira volatility rose sharply”.

But immediately after winning the second round with 52 percent of the vote on Sunday, Erdogan insisted he would keep interest rates low even as inflation now exceeds 40 percent.

“If anyone can do it, so can I,” he said. “(The central bank’s key interest rate) has now come down to 8.5 per cent and you’re going to see inflation come down as well.”

“The question of undoing inflation-induced price increases and welfare losses is the most pressing topic in the coming days” – without giving specifics, he added.

Investors also worry that if the lira weakens, Turks will spend the equivalent of $121 billion in special savings accounts, with the government footing the bill.

The measure has slowed Turks’ purchases of foreign currency, but Finance Minister Nureddin Nebati said the country has lost around 95.3 billion Turkish lira ($4.7 billion) since the accounts were introduced in 2021.

If the lira falls faster in the coming weeks, the hit to public finances could mount rapidly.

However, analysts believe Erdogan may be able to secure new funding from allies in the Middle East and Russia.

The president said last week that unnamed Gulf countries had provided funds to help stabilize the Turkish market, without elaborating.

Wolf Piccoli of consultancy Teneo said Erdogan could get a short-term boost from summer tourism cash receipts, which tend to ease the country’s fiscal strains.

Turkey’s Bist 100 stock index also rose more than 4% on Monday, buoyed by locals seeking safety from high inflation.

Some economists say Erdogan may appoint a new economic team, bringing back names familiar to foreign investors.

“As our election wraps up, all eyes will be on the makeup of the economic team and the credibility of the initial policy response,” said Citigroup’s Ilker Domac.

But Domark also warned that it would be “increasingly challenging” for the central bank to keep interest rates well below inflation, “especially in the last quarter of the year and beyond.”

Other economists expressed a greater degree of caution.

“Prepare for the worst, which may require formal capital controls or severe deposit flight from the banking system,” wrote Atilla Yesilada of Istanbul-based GlobalSource Partners consultancy.