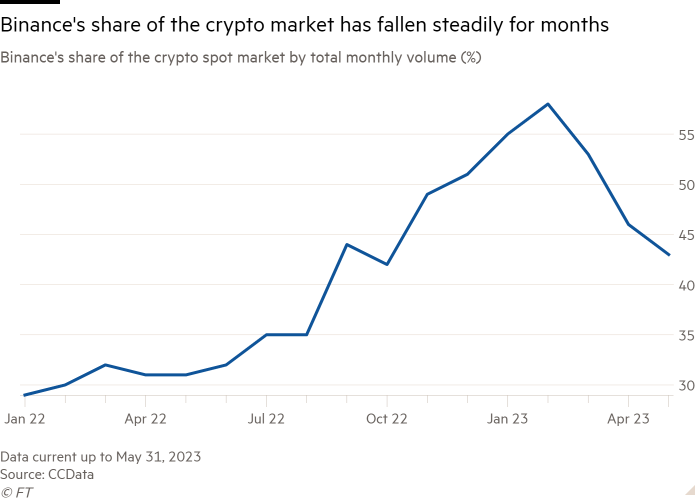

Binance, the world’s largest cryptocurrency exchange, has lost a quarter of its market share in the past three months as U.S. regulators pursue it for alleged violations of federal law.

The group, which says it has no headquarters, controlled 57.5% of the average monthly trading volume on global cryptocurrency exchanges at its peak in February. But that has now dropped to 43%, according to research provider CCData.

Binance saw a sharp decline as it faced greater competition for business, increased scrutiny of its activities by U.S. regulators, and the end of its free trading promotion.

In February, New York regulators shut down the offering of Binance-branded stablecoins. Stablecoins are cryptographic tokens used as a store of value among crypto market bets, as they are designed to track the price of the U.S. dollar and other traditional currencies.

At the time, the token, called BUSD, accounted for about 40 percent of the company’s monthly trading volume.

“The end of the BUSD issuance has had an impact on the exchange’s liquidity, which intensified the pressure on Binance because they knew their branded stablecoin was in the media and they were forced to drop it,” said Ilan Solot, co-director of the London-based The digital asset of the financial services group Marex.

Weeks later, U.S. derivatives regulator the Commodity Futures Trading Commission filed a lawsuit against the exchange, claiming that most of Binance’s reported trading volume and profitability came from “extensive solicitation and exposure” to U.S. clients. Binance said at the time that it disagreed with the CFTC’s allegations.

Its market share was also hit by the end of a promotion that gave customers free trades on some bitcoin pairs, which fueled growth late last year but ended in March.

“Once those deals close, the volumes will naturally drop, which obviously affects their short-term market share,” Solot said.

While Binance’s grip on the market has waned, other exchanges — including OKX, BitMex, Bybit and Bullish — have increased their market share since March.

Binance’s market share slip comes as it plans a round of layoffs, which the company said on Wednesday was “not a case of appropriate layoffs,” but rather an indication of whether the company “has the right talent and expertise in key positions.” “Reassessment”.

Founded in 2017, Binance has grown from a team of 30 to over 8,000 employees.its chief strategy officer, Patrick Hillman, on Wednesday describe The layoffs are a “historic operational challenge” following the company’s “exponential growth over the past five years”.

Binance declined to confirm the number of employees that would be affected by the layoffs. Binance had previously laid off between 5% and 12% of its staff, a person familiar with the matter said.

Recent cryptocurrency market conditions also played a role in Binance’s decision to lay off staff, according to another person familiar with the matter.

“(Market factors) mean we may adjust or realign our (resources) . . . It doesn’t take a genius to put these things together,” they said.

After several years of hypergrowth, many cryptocurrency companies were forced to retrench due to last year’s industry downturn, when tokens such as Bitcoin lost around 70% of their value and many high-profile firms, including Celsius Network and FTX, went out of business . Among them, Coinbase and Crypto.com have made significant layoffs.

Despite layoffs elsewhere, Binance said it continued to fill hundreds of job openings amid the cryptocurrency’s historic downturn. Chief Executive Officer Changpeng Zhao said on Wednesday that the company has a “bottom-up” policy whereby “unsuitable” people leave.

“The ‘program’ is constant. I push it every week,” he said.