Big money managers missed out on Nvidia’s rally and raced to catch up over the past two weeks, racing to add to the U.S. company that has become the top pick for artificial intelligence investing.

State Street, Fidelity, Amundi, Ameriprise’s Columbia Threadneedle and Loomis Sayles all cut their positions in Nvidia in the first quarter of 2023, before a strong rally pushed the chipmaker’s valuation to $10,000, according to securities filings. One hundred million U.S. dollars. They’re far from alone, according to an analysis by Goldman Sachs: Mutual funds have generally reduced their exposure to Nvidia in early 2023, making the stock one of their most underweight.

But fund managers are adding to positions again, according to interviews with Wall Street bank traders. Mutual funds and hedge funds have been scrambling to cover their positions in other AI-related growth stocks such as Nvidia, Advanced Micro Devices and semiconductor exchange-traded funds.

“A lot of people have generally underestimated the room for growth beyond 2022,” said Brian Post, co-head of equity derivatives for the Americas at Barclays. But now, he said, “we’re at a point where a lot of people are being forced into the market”.

That helped prop up Nvidia’s stock price, which surged from $305 per share to a high of $419 after the company reported strong earnings on May 24 and issued generous revenue guidance, citing interest in the technology used to generate AI. chip needs.

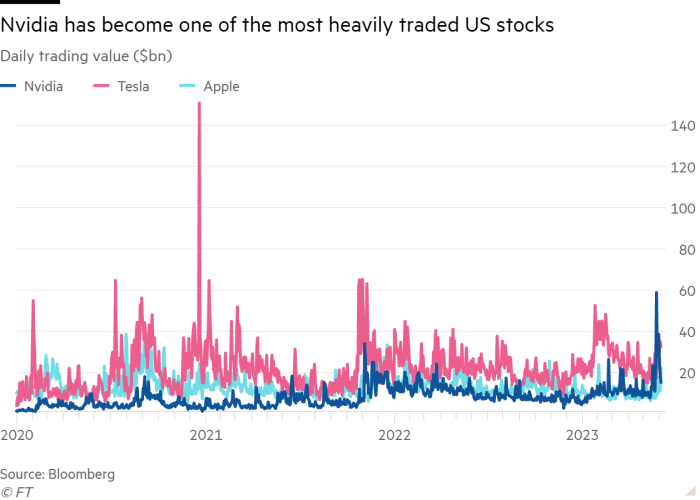

Traders noted that there was little appetite to buy Nvidia stock, meaning many trades were relatively small volumes. Daily trading volumes have more than doubled to an average of $32 billion, but trading desks say they are sometimes unable to keep up with demand.

The stock has since retreated from its highs, closing at $386.54 on Tuesday, which Wall Street traders said suggested demand was being met for now.

Many funds buy Nvidia stock programmatically, using algorithms to help guide their purchases, traders said.

“Frankly, I’ve never seen a change in guidance like this,” said a tech trader at a Wall Street bank, adding that after the company released its latest data, “people did the math and it became (their) Must own . . . the chase (has) begun”.

Tech stocks make up relatively small positions in many mutual funds compared with their weighting in the S&P 500, the benchmark used to judge the performance of many managers. Nvidia now accounts for 2.7% of the S&P 500, up from 1.1% at the end of 2022.

Many fund managers are opting to stay light on technology stocks for reasons including avoiding concentrated bets on individual companies. But the reduction led to relative underperformance.

Given that the seven largest companies in the Russell 1000 Growth Index — Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta — make up 42% of the index, this problem has been acute for growth stock funds. Goldman.

Stuart Kaiser, head of U.S. equity trading strategy at Citigroup, said the recent surge in tech stocks “is a bit uncomfortable … . . but no one wants to miss it.”

Traders said the buying was broad and lacked the hallmarks of large deals by a single player, such as family office Archegos Capital Management, which rocked markets when it collapsed in 2021. Armies of retail investors once organized to buy stocks on social media are less visible now.

Even big hedge funds had to pivot quickly.

The three major Wall Street prime brokers that trade with hedge funds — JPMorgan Chase, Bank of America and Morgan Stanley — were all listed among the top 10 investors in Nvidia at the end of March. Last quarter, only one investment bank was such a major shareholder.

Wall Street views such brokerage holdings as a rough proxy for hedge fund positions. Brokers regularly provide hedge funds with stock exposure through stock swaps, in which the broker buys the underlying security and enters into a derivative contract that reflects the rise or fall of the stock.

In the weeks leading up to May 24, several large hedge funds trimmed their positions in Nvidia, hoping to lock in profits after the stock more than doubled since late last year, according to the head of the trading desk.

But a backlash after companies issued new guidance prompted a reinvestment of funds.

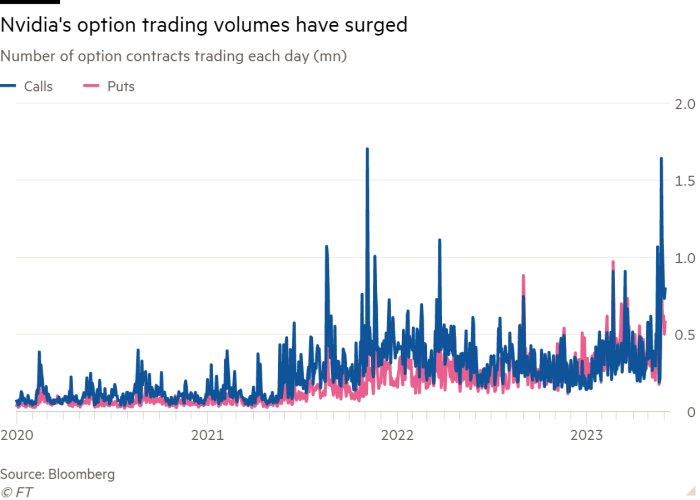

In another derivative trade, investors bought put options ahead of Nvidia’s results, said Akshay Narayanan, head of equity options trading at proprietary trading firm Optiver. A put option pays out if the security’s price falls below a given level by a certain date.

But since May 24, investors have traded more call options.

“People are asking ‘Is this valuation a little bit too high, is a large part of this stock price rise speculative?'” Narayanan said. “But earnings can provide more substance . . . Now (investors) are asking whether the gains will be enough.”

Traders expect near-term volatility to continue. Options prices suggest traders are expecting twice the normal level of volatility around the date of Nvidia’s next quarterly earnings release. Traders are also predicting volatility surrounding events such as AMD’s upcoming “AI technology premiere.”

Fidelity, State Street, Amundi, Ameriprise and Columbia Threadneedle all declined to comment. Loomis Sayles said it owns 11.5 million Nvidia shares across multiple investment teams, the vast majority of which are “hold the stock for the long term” growth strategy.