BRICS nation China is on a gold accumulation spree by stockpiling the precious metal in the country’s reserves. China raised its gold holding by 8.09 tons in April, according to data from the State Administration of Foreign Exchange. Apart from China, the other BRICS nations Brazil, Russia, India, and South Africa are also extending gold purchases through their respective Central Banks.

Also Read: Europe Might Get Ready To Accept BRICS Currency

BRICS: Why Is China Buying Large Amounts of Gold?

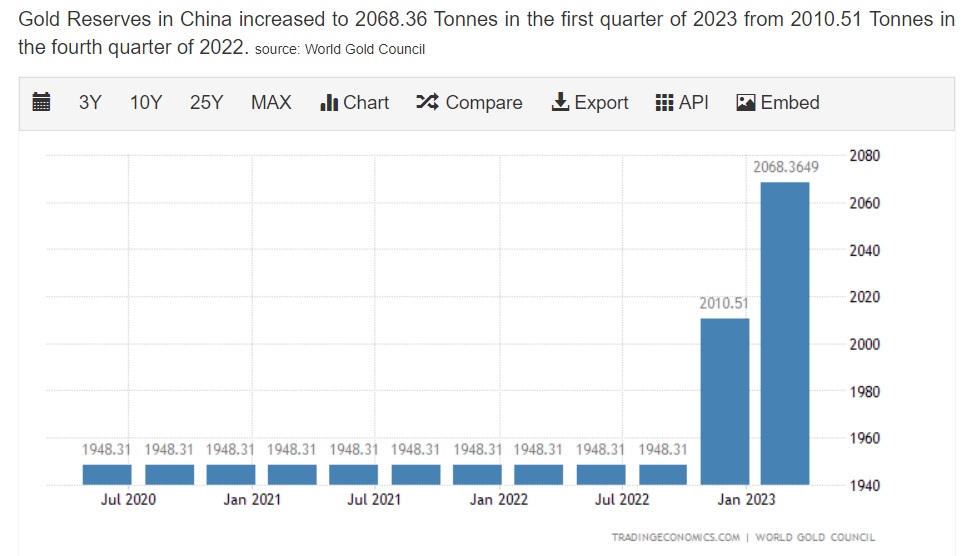

Reports suggest that the soon-to-be-released BRICS currency could be backed by gold and therefore the bloc of nations is splurging on the metal. China is leading the pack by accumulating massive amounts of gold in both Q1 and Q2 of 2023. China has a total of 2,076 tons of gold accumulated in a year after an increase of 120 tons through March. In April, the reserves grew by another 8.09 tons making the BRICS bloc the top buyer of gold.

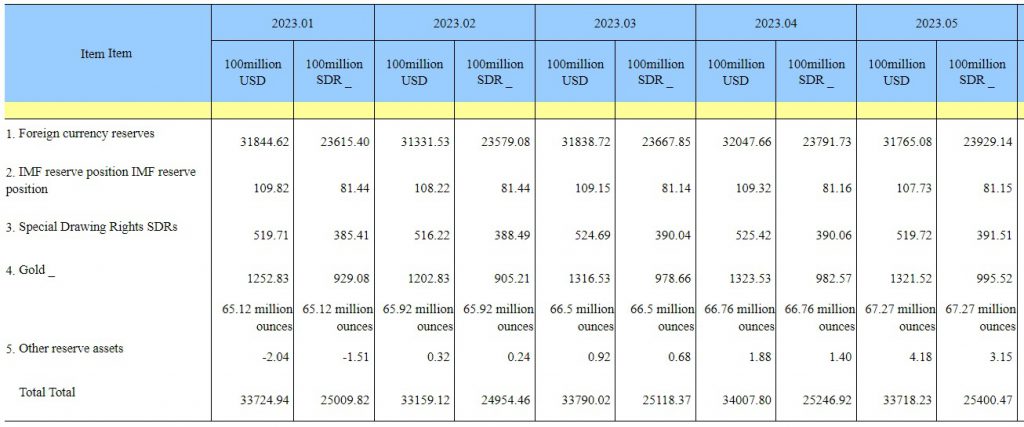

On the other hand, China’s April foreign reserve currency holdings rose to $3.2048 trillion, up by $20.9 billion from March. The rise in foreign exchange comes after the U.S. dollar depreciated due to global macroeconomic factors. China’s economic rebound will add pressure to the U.S. dollar and a new BRICS currency could worsen the USD’s prospects.

Also Read: Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance

The BRICS bloc needs gold to back its upcoming currency and end reliance on the U.S. dollar. The CEO of U.S. Global Investors Frank Holmes said that the pattern of BRICS nations buying gold is worrisome.

Also Read: BRICS: 16 Asian Countries Move to Ditch the U.S. Dollar

“If you look back at the list of net buyers (gold). You’ll notice that three are members of the BRICS countries. I point this out because, as I’ve been sharing with you for a couple of weeks now, we may be seeing the emergence of a multipolar world, with a U.S.-centric world on one side and a China-centric world on the other,” he said.