If Labor maintains its lead in the polls and wins the next election, slower growth, trade tensions, strained public services and weak public finances will present the incoming government with a more challenging economic succession than 1997.

Unlike the relatively benign problems facing Tony Blair and Gordon Brown 26 years ago, when Labor won power after a long-running Conservative government, former politicians, officials and current experts expect Sir Kilstarmer’s government to fail in terms of economic performance and public funds.

If Labor wins in 2024, former prime minister Ken Clarke’siron lawThe politics of ” – where the Conservative government is there to clean up the mess left by the Labor government – will not apply.

Paul Johnson, director of the independent Institute for Fiscal Studies, said: “Given the circumstances – high inflation, high debt, taxation already at an all-time high – the outlook looks bleak for a new government looking to boost spending.”

Starmer project

This is the third and final part of a series looking at the Labor leader’s plans ahead of an election expected next year – and how he’s doing it

Part 1: A surprisingly bold economic agenda

Part two: Labour’s ruthless transformation

Shadow chancellor Rachel Reeves didn’t miss it all. In an interview with the FT, she turned Clark around, saying that while the previous Labor government had inherited a “reasonable” position, “we have inherited a mess this time”.

“Liam (Byrne, then Chief Secretary to the Treasury) wrote some stupid notes (in 2010) saying there was no money, but now it’s worse because this government is borrowing more money than Labor has ever been, ’ she added.

Ed Balls, who came to the Treasury in 1997 as Brown’s economic adviser, said that while it was different from that era, one thing that seemed similar was that “nobody was listening” to the Conservatives’ arguments on the economy, regardless of their What are the advantages.

“After Black Wednesday and rising interest rates, the Conservative Party is unlikely to recover from the massive macroeconomic failure that affected people’s lives,” he said, referring to the disastrous withdrawal of sterling from the European Exchange Rate Mechanism in 1992.

“It’s likely to be similar to what happened last fall, as yet another failure of macro policy raised concerns that their jobs and living standards may not recover,” Balls added.

If true, it would help Labor get to power – but not help the new government emulate the economic performance of what former Bank of England governor Lord Mervyn King called the “good decade” after 1997.

Economic Growth

Since the global financial crisis of 2008-09, the growth performance of the UK economy has deteriorated relative to historical averages and compared to other advanced economies.

In the 60 years after World War II, chancellors had to deal with stagnant expansion, recession, inflation and turning to the IMF, yet the economy grew steadily at an average rate of about 2.5% a year.

But that stopped after 2008, and there’s no sign of a return to those healthy rates. In the five years leading up to 1997, the economy grew by an average of 2.8 percent a year, and in the five years leading up to the 2024 election, it is projected to expand by just 0.2 percent a year. The OBR, which takes a relatively optimistic view, expects better performance in a few years before the economy stabilizes to an average annual growth rate of 1.75%.

Many other forecasters, including the Bank of England, are more pessimistic.

Across the income distribution, large gains in living standards have given way to more modest growth, as households bear the brunt of slow productivity growth and the brunt of the pandemic and energy crisis. Even with increased government borrowing and state support in 2021-22 to help households weather the pandemic, income growth remains low.

Families may be hoping a Labor government will deliver better times for living standards. But with productivity growth not as hot as it was before the global financial crisis, and signs that the world is entering a more protectionist phase, and globalization not delivering big gains — contrary to what happened in 1997 — Powers is critical of the The economic backdrop is pessimistic.

“We couldn’t have known it before 1997 . . . but the global economy was entering a benign period of strong growth and globalization that certainly benefited the Labor governments of the 2000s,” he said. “As the global situation becomes more volatile and unstable, we are unlikely to repeat the same mistakes.”

Room to improve economic performance

Civil servants and Labor politicians who served between 1997 and 2010 stress that the Blair and Brown governments also tried to do themselves good fortune with policy reforms to improve the labor market, reduce unemployment and boost business investment.

While the success of these policies in boosting growth has long been debated, there is no doubt that the Labor government and then the Conservative-led government both put people back to work and helped boost growth.

Compared with when the unemployment rate fell from 7.2% after 1997 to now 4% among 16 to 64-year-olds, there is now less room to attract more people into the economy, although there is some room to attract smaller numbers of people are now returning to the workforce from long-term illnesses.

Lord Nick Macpherson, permanent secretary to the Treasury between 2005 and 2016, said that in the 1990s “there were only so many people who could be sucked into the workforce”.

“This time around, we’ve got the odd situation of a massive labor shortage, but we don’t have a strategy to provide that workforce with the skills we need. It’s going to be a horrendous workforce constraint.”

Another former senior Treasury official said ministers and officials would need to think hard about “industrial policy”, with the UK increasingly having to compete with huge spending and subsidies from the US and other European countries.

“It’s a big strategic issue, half of the finance ministry hates the idea (of subsidies) because it would waste a lot of money, while the other half thinks it’s necessary,” the former official said.

Public Service

A Labor government focused on reviving growth will also face a more pressing problem: meeting voters’ growing demand for better public services.

Balls said it was similar to what happened in 1997, when funding for health services was less generous than in other European countries, and the previous major government set strict spending plans for the two years after 1997 that Blair and Brown had promised to abide by.

“You can’t have hip surgery in 18 months and not have a schoolhouse in 18 years,” Balls said.

Some pressures on public services were greater 26 years ago – for example, crime rates were significantly higher – but most are much more dire now.

The NHS waiting list is much larger now than it was in 1997, when Mr Blair told voters on election eve they had “24 hours to save the NHS”. Chancellor Jeremy Hunt’s public spending plans for the years after the 2024 election are as tight as they were in 1997.

Even if the workforce is tighter than it was in 1997, pressure on public services will follow. While major governments cut wages for public sector workers, compared with the private sector, IFS research shows that relative conditions were better in the late 1990s. The Blair government has also been able to raise more money for many parts of the public sector by further reducing defense spending.

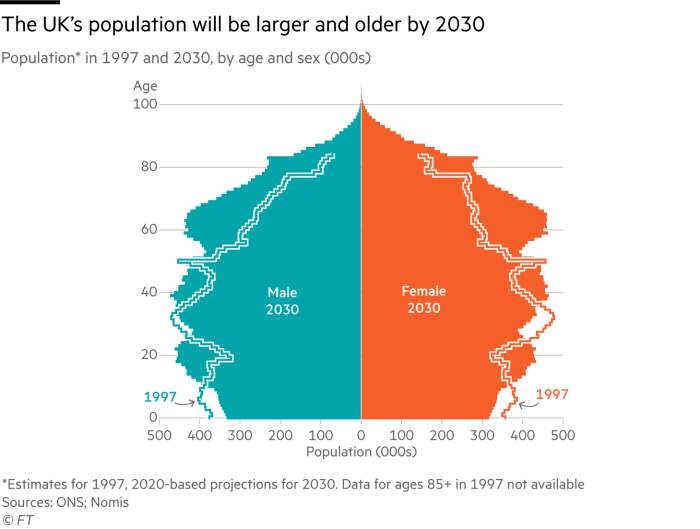

In the context of the conflict in Ukraine, this option is less feasible today, and the other benefits do not apply. Torsten Bell, chief executive of the Resolution Foundation, said that as the population ages and baby boomers retire – older people are now more reliant on the workforce than they were in 1997 – the need to fund public services without raising taxes The prospects look implausible.

“Just like in 1997, the NHS is under pressure and it’s underperforming, but what’s very different is that the expected growth in the over-65 population is putting upward pressure on service costs at the same time, because the size of the workforce is falling,” Bell said.

public finance

If Starmer and Reeves don’t worry enough about the UK’s slowing growth, a more challenging global backdrop, worse demographics and more stressed public services, they will also start with a less healthy public finances.

In May 1997, public sector net debt was 37.6% of gross domestic product (GDP), and by April 2023 this debt level will be two and a half times as high as it is today, at 99.2% of GDP % and still rising, despite an increase in tax revenues to the highest level since World War II.

Although many aspects of the public sector, such as education, health, and transportation, are more modern than they were in 1997, the increase in debt has not been supported by increases in public sector net worth.

The ONS’ new aggregate public sector net worth statistics have deteriorated from a £96bn surplus in spring 1997 to a £611bn deficit at the end of April 2023 after the government borrowed heavily through the global financial crisis, the Covid-19 pandemic and recent energy crisis.

Reeves was clear “there’s not a lot of wiggle room”, saying the government couldn’t simply borrow its way to improve public services. “Liz Truss and Kwasi Kwarteng tested the idea of disrupting deficit-financed spending, so it’s important that we explain where the money comes from,” referring to the former prime minister and her Prime Minister.

potential good news

With the new Labor government facing such a difficult economic and public finances backdrop, most economists and former officials warn that the outlook is tough, but they stress that it is not impossible and that in the past the UK has often seen things improve as everyone in despair.

IFS’s Johnson said: “(Labor) has the potential to get lucky in the economy. Seven years after the Brexit referendum, we took the initial hit. The political chaos seems to have subsided. Maybe, just maybe, we’ll get back to decent growth. Can’t count on it.

McPherson also said that history does not all portend doom and gloom for the next few years. “Just when you think everything is bad, economies tend to turn around and I can see some reasons why the economy could regain its ability to grow – for example, the backlash from Covid and energy prices is coming to an end.”

“I don’t see a clear investment boom coming, but it’s important to keep the foresight and the UK is no worse off than anywhere else,” he added.

data visualization Keith Fry and alan smith