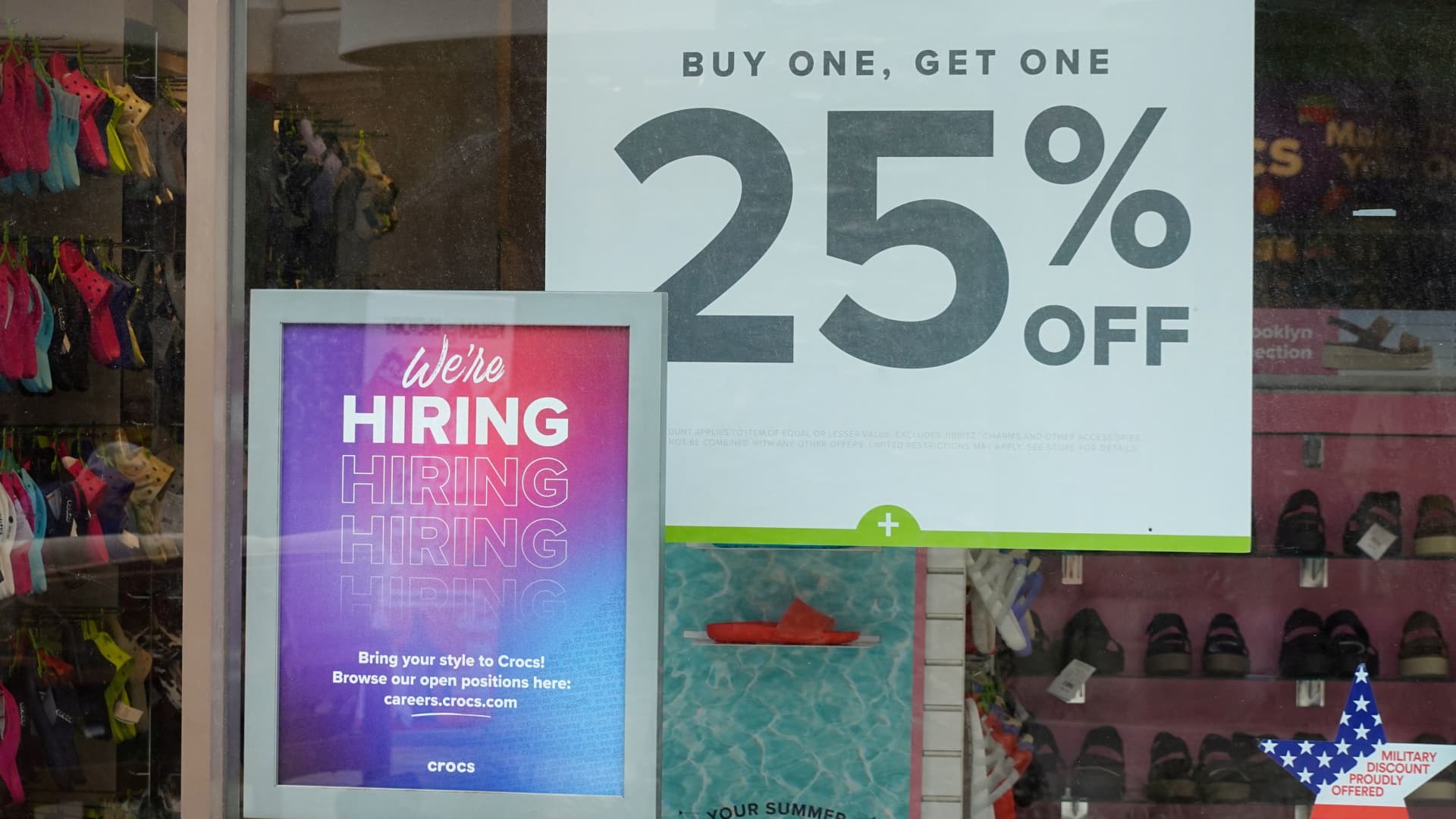

Employment signs and sale signs are displayed at a retail store in Carlsbad, Calif., May 25, 2023.

Mike Black | Reuters

With the first half of 2023 winding down, a widely predicted U.S. recession remains elusive, but the consumer sector that has driven a remarkable recovery from pandemic shutdowns may finally be showing signs of weakness.

Right now, the signals economists use to gauge the likelihood of a recession are conflicting. The yield curve remains deeply inverted and manufacturing surveys have been flashing recession signals for months. But the layoffs, centered in the tech industry, have so far not been widespread, and consumer areas like travel look like an outright boom.

Related investment news

With the Federal Reserve not expected to raise interest rates at its next meeting, hopes of a so-called “soft landing” for the economy are sprouting again. On Tuesday, Goldman Sachs cut the chance of a U.S. recession in the next 12 months to just 25%.

But, with pandemic-era savings dwindling and interest rates high, can the robust consumer sector continue to hold up? Not everyone is convinced, with some Wall Street strategists and economists arguing that a recession is only a matter of time before central banks try to bring inflation down — and there’s plenty of evidence to support that pessimistic view.

“U.S. and global expansion took hold, and fears of an impending recession appear overblown. The latest releases showed a surprise rise in global manufacturing PMIs, alongside strong gains in U.S. goods spending and employment. But These numbers also suggest that the seeds are being planted to end the expansion,” JPMorgan global market strategist Marko Kolanovic said in a note to clients on Monday.

confused consumer

The housing market is one of the leading bellwethers for the U.S. consumer and the economy, and one of the most confusing.

new home sales Despite rising mortgage rates and regional banking crises, it has actually trended up again in recent months, reversing last year’s sharp slowdown.

This time around, however, the reading on consumer health may not be very good. The number of existing homes coming to the market has fallen sharply, exacerbating the national housing shortage and potentially making demand look stronger than it really is.

“If you own a house, if you lock in a 2.8 percent 30-year mortgage, that’s the best deal of your life. You’re not going to move unless you have to,” says The Economist and Portfolio said strategist Lauren Goodwin at New York Life Investments.

Consumer staples companies are also sending conflicting signals. Target warned of sluggish sales last month, and dollar generalShares plummeted on June 1 after the discount retailer slashed its full-year outlook.

Shares of Dollar General fell sharply after the retailer cut its full-year outlook.

But on the other hand, American airlines Profit guidance was raised on May 31, citing strong demand and cheaper fuel.and luxury clothing brands lululemon Earnings and sales beat expectations for the fiscal first quarter and raised its full-year guidance.

The disparity could be a continuation of the post-pandemic economy, with consumers splurging on areas such as travel while catching some retailers off guard with their inventory plans. But it could also be a sign that the economic recovery is becoming a “K-shaped,” Goodwin said. This means that there are differences between consumers in different income brackets.

“I don’t want to dismiss the idea that some companies might have particular problems with inventory management. That’s always part of the story. But what we’re seeing in the aggregated data is a major divide between lower and middle-income consumers about the broader economy and high-income consumers. Income consumer impact,” she said.

“The divide isn’t just in income brackets, it’s in age,” Goodwin continued, referring to credit card default rates.

“That, to me, is, it’s a story about wealth and excess savings,” she added.

Last stop on the labor market?

The main source of optimism for the US economy is the labor market, where continued job growth will boost low-income consumers and help counter the K-shaped economy.

Even with reports of a fresh round of layoffs at major companies, including meta platform, disney and Goldman Sachs, the monthly jobs report continued to beat expectations. The April JOLTS report even showed an unexpected increase in job vacancies.

However, Nick Bunker, director of North American economic research at jobs site Indeed, said his firm’s data showed that hiring has continued to soften in recent weeks, with the job market having cooled since the early days of the recovery.

“Things are easing, even though they’re still very strong,” Bunker said.

The May jobs report itself was a conflicting document. While payrolls unexpectedly rose by 339,000, the unemployment rate, calculated from a separate survey, actually rose to 3.7%.

“It’s just one of those wacky reports. The unemployment rate went up 3-10 percentage points — I don’t think that’s an accurate reflection of the health of the labor market. I also don’t think the 339,000 jobs we created in a month was a Accurate reflection … my take on this is that I’m not going to be overhyped in either direction,” Bunker said.

The labor market is often seen as a lagging indicator of economic weakness and is no guarantee that a recession isn’t just around the corner. Initial jobless claims unexpectedly jumped to 261,000 on Thursday, a possible warning sign that cracks in the labor market are starting to widen.

— CNBC’s Michael Bloom contributed reporting.