The use of aging ships by Russian oil exporters has nearly doubled since the start of the Ukraine war, sparking concern in the shipping industry that ships belonging to the scrap heap are putting workers and the environment at risk.

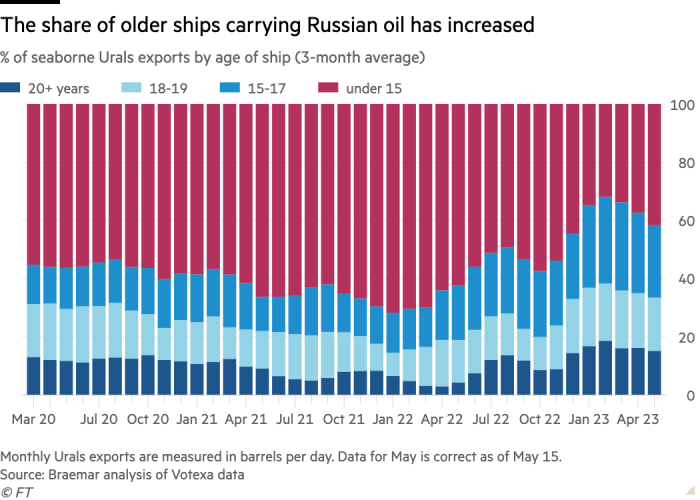

Since the start of the war, the share of seaborne exports of Urals crude, Russia’s main blend, has surged on ships over 15 years old, according to shipbroker Braemar. In the six months leading up to the conflict, the average carry share of older ships was 33.6%. Since December 2022, the share has been at 62.6%.

Western countries have imposed a series of restrictions on sales of Russian oil since the full-scale invasion of Ukraine in February 2022, but total seaborne exports continue to rise as the product flows to Asia.

Big oil companies typically consider scrapping tankers after 15 years of wear and tear, but more and more ships past that age are being bought by unscrupulous owners willing to buy older, cheaper ships, industry sources say.

When they go into the shadows, these tankers are less likely to be properly inspected and operated by experienced crews, which could increase the risk of accidents that could lead to oil spills and even fatalities.

“There’s been a lot of discussion about whether these ships meet international standards,” said Henry Curra, director of research at Braemar. “The assumption is that (they) are not.”

The potential number of older ships left on the water is so great that they could soon represent a significant portion of the entire shipping fleet. Braemar predicts that by 2025 the share of the global tanker fleet that is 20 years or older could increase from 6% to 16%.

The data came shortly after reports of an explosion on an oil tanker in the South China Sea shocked the shipping industry. Authorities said last week that three crew members were still missing from the Pablo tanker, which was built in 1997 and is linked to shipping sanctioned Iranian oil.

Sanctions on Russia have expanded the shipping of dangerous but potentially lucrative goods restricted by Western lawmakers, which also includes oil from Iran and Venezuela. This month, the Financial Times reported that an Indian company that transports Russian oil has quickly become one of the world’s largest tanker owners, acquiring nearly 60 tankers in two years.

Braemar, which connects boat sellers with buyers, has become “more stringent” in its “know your customer” checks, Curra said.

“Since Russia imposed sanctions, every counterparty has to be checked,” he said.

A London-based lawyer said clients would now “have to be very careful” about selling ships or sending them for recycling, given the increased risk that tankers could be bought by unscrupulous owners or middlemen.

“When a ship enters the Dark Fleet, all behavior that meets international standards disappears,” the lawyer said.

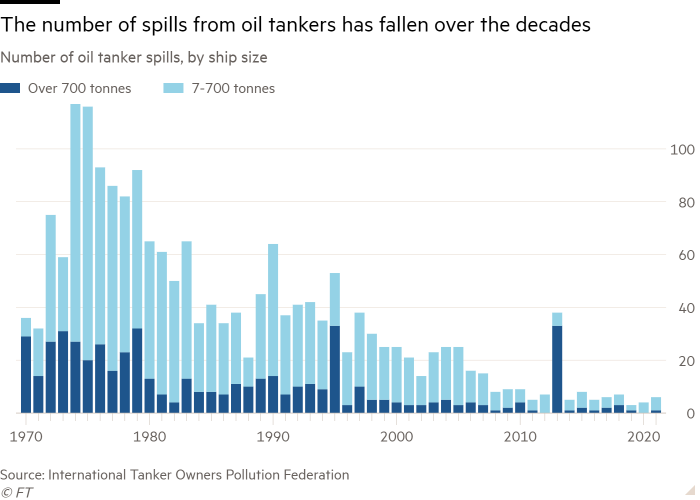

Industry insiders worry that some of the progress made in raising environmental standards could be reversed. The number of oil spills from tankers has declined steadily since the 1970s, according to data compiled by the International Tanker Owners Pollution Consortium.

Last month, the chief executive of one of the world’s largest shipping insurers told the Financial Times that “this is a social and environmental catastrophe on the horizon”.

Rolf Thore Roppestad, head of Norway’s Gard, warned that if an accident did happen, “nobody would be there to pay the price”.

Additional reporting by Chris Cook in London