Japanese stocks have outperformed their Asian counterparts so far this year as investors cheered the prospect of real corporate governance reforms that would force Japanese companies to improve efficiency and productivity while boosting shareholder returns.

Richard A. Brooks | AFP | Getty Images

For the first time in decades, Japanese stocks are back in vogue.

Over the past few weeks, the benchmark Nikkei 225 Index The Topix and Topix hit their highest levels in more than 30 years as foreign investors piled into Japanese stocks with a consistency rare in at least a decade.

A decade ago, when “Abenomics” first ignited hopes of corporate governance reform in Japan, many seemed to have a better view of the Tokyo Stock Exchange’s latest move, but it turned out to be a false dawn.

“The recent move by the Tokyo Stock Exchange is a game-changing moment as it will challenge many companies, which are trading below their one-time book prices, to boost profitability and prop up their share prices,” said Oliver Lee. , Singapore Client Portfolio Manager.

this Tokyo Exchange Group Market restructuring rules have recently been completed.One of the latest measures is to instruct listed companies if they trade below Price-to-book ratio One – Indicates that a company may not be using its capital efficiently.

Such companies could face the prospect of being delisted as soon as 2026, the exchange warned.

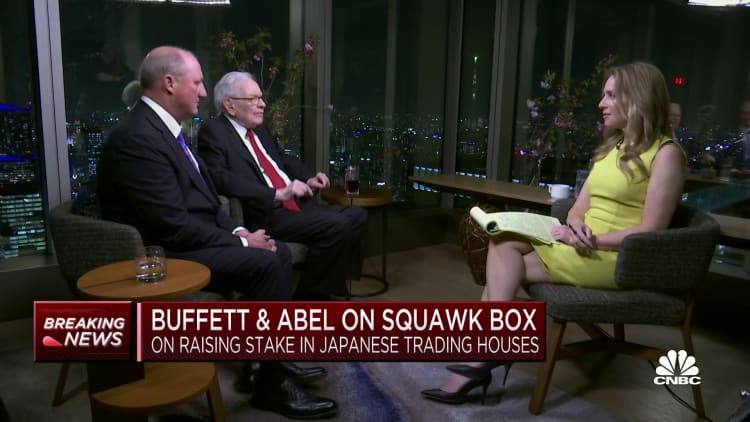

The optimism in Japanese stocks stems in part from how specific and tangible the Tokyo bourse’s request was this time around. Warren Buffett’s bullishness on Japanese stocks also helped boost confidence among foreign investors.

It is hoped that this will force Japanese companies’ notoriously resistant management – which often views shareholders as an enemy – to improve capital efficiency and profitability. Once big companies start making changes, this could in turn trigger a domino effect among other Japanese companies.

“Until recently, the problem was that despite a healthy increase in corporate activism, companies and managers still weren’t that active in listening to shareholders,” Yunosuke Ikeda, Nomura’s chief equity strategist, told CNBC last week.

The scale of change — or disappointment — is enormous.

The exchange said in March that half of its “premium” listings — the most liquid and largest by market capitalization — and about 60 percent of its “standard” listings had a return on equity of less than 8 percent, and were based on Trade with a price-to-book ratio below one.

The price-to-book ratio is the ratio of the total market value of a company’s stock price to its book value (the company’s net assets). Return on equity is a measure of a company’s profitability.

These companies must now show how they plan to become more capital efficient, as data points suggest they are likely to be trading below their cost of capital and therefore less likely to achieve capital efficiency. Part of those rules required them to demonstrate how they were attracting investors and began publishing public disclosures in English.

If a company fails to meet higher listing standards by the end of an ongoing transition period and a one-year “improvement period,” its securities could be subject to regulation and could face the prospect of delisting within six months.

“Delisting or any punishment or any enforcement is unlikely, but the good news in Japan is that there is peer pressure,” Nomura’s Ikeda said. “If rival companies make huge improvements in corporate governance, other companies will tend to follow suit.”

The Long Tail of Abenomics Reforms

The goal is clear.

in a Documents released at the end of Marchthe TSE operator hopes to ensure sustainable growth and increase corporate value for the company in the medium to long term by focusing on balance sheet-based cost of capital and profitability, rather than just sales and profit levels on the income statement.

In other words, they want to see real strategic change being made with shareholders.

The reforms are part of a broader multi-year structural overhaul whose origins can be traced back to Abenomics — the aggressive set of economic policies launched by the late Shinzo Abe when he was prime minister in the early 2010s.

Corporate governance is the “third arrow” of the three core tenets of Abenomics — monetary easing and fiscal stimulus being the other two. The much-touted economic policy aims to revive growth and combat the chronic deflation that has plagued the world’s third-largest economy since the 1990s.

While initial optimism about Abenomics in Japanese stocks was short-lived in the early 2010s, investors now see the potential for a fundamental re-rating if these latest corporate governance reforms take hold.

Better corporate governance has been attracting more international investors, including recent investors such as Warren Buffett’s Berkshire Hathaway…

Former M. Colpan

Professor of Corporate Strategy, Kyoto University

“Investing in Japanese stocks is not investing in Japanese macro, it’s not an investment thesis,” said Shuntaro Takeuchi, a Japanese fund manager at Matthews Asia in San Francisco.

“It’s investing more in margin growth opportunities that come from better margins, better return on equity, better total returns.”

Buffett effect

Known as “sogo shosha,” Japanese trading companies resemble conglomerates that deal in a wide range of products and materials and help propel the Japanese economy onto the global stage.

While their diverse businesses are part of what attracted Buffett, some investors have criticized their complex operations and highlighted their growing exposure to overseas risks as they expand internationally.

Buffett’s disclosure in May helped spur net buying of Japanese stocks by foreign investors for 10 consecutive weeks. Foreigners bought a net $57.8 billion worth of Japanese stocks in the past 10 weeks to June 3, according to Japan’s finance ministry.

“Investors, especially foreign investors, are putting pressure on them to comply,” said Asli M. Colpan, a professor of corporate strategy at the Graduate School of Management and Economics at Kyoto University.

“Better corporate governance has been attracting more international investors, including more recently such as Warren Buffett’s Berkshire Hathaway; more international investors are imposing greater scrutiny on compliance Stress — it’s a virtuous circle,” she added.

Flush with cash, easy wins

This is already starting to tell the story.

“Cash flow generation and accumulation is now at a level where more than 50% of companies are net cash due to profit growth, and they may have too much cash on their balance sheets,” said Takeuchi of Matthews Asia.

We’re probably only halfway through the corporate transformation journey.

oliver lee

Hanspring Investment

“But in the longer term, a bigger factor is whether they will maintain a focus on profitability through cutting underperforming business units and restructuring,” he added.

These are more difficult decisions to make, but ultimately will be a true gauge of Japanese companies’ willingness to reform and improve efficiency and productivity.

However, the general direction of Japan’s long-term structural change is clear.

In a world battling stubbornly high inflation and facing subdued growth prospects, this only adds to the allure of Japanese equities — which, aided by Japan’s easy monetary policy, are relatively weak after years of chronic deflation. tame inflation, a weak yen, and Valuations are relatively cheap.

“We’re probably just halfway through the company’s reform,” Li said.