The U.S. Labor Department reported on Tuesday that inflation fell to its slowest annual rate in two years in May.

this consumer price indexAn index measuring changes in a wide range of goods and services rose just 0.1% for the month and fell to a 4% annual rate. The 12-month increase was the smallest since March 2021, when inflation was just starting to rise to its highest level in 41 years.

Strip out volatile food and energy prices, and the picture is less rosy.

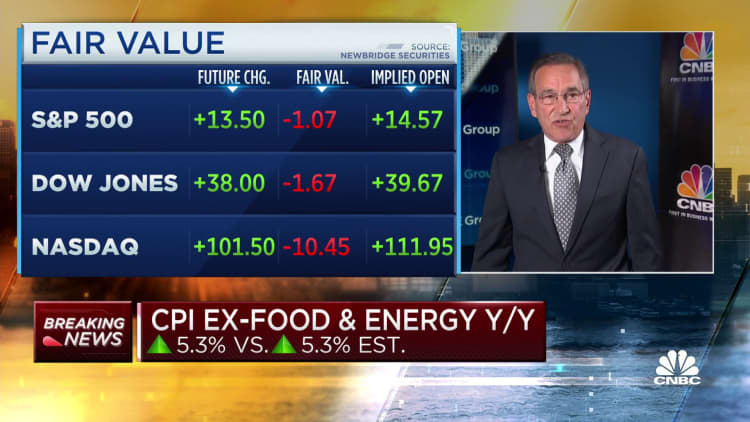

So-called core inflation rose 0.4% for the month and was still up 5.3% from a year ago, suggesting that while price pressures have eased, consumers are still under pressure.

All of these figures are well within the Dow Jones consensus estimate.

A 3.6 percent drop in energy prices helped curb CPI gains for the month. Food prices rose just 0.2%.

However, a 0.6% increase in housing prices was the largest contributor to the increase in any item or headline CPI reading. Housing-related costs make up about one-third of the index’s weight.

Elsewhere, used car prices rose 4.4%, the same as in April, while transportation services rose 0.8%.

Markets showed little reaction to the news, although the Fed is expected to make a decision on interest rates at its meeting this week. Stock futures edged higher despite sharp falls in U.S. Treasury yields.

Pricing in the fed funds market has indeed shifted significantly, with traders now pricing in a near-100% chance that the Fed won’t raise its benchmark rate at the end of Wednesday’s meeting.

“Encouraging trends in consumer prices will give the Fed some leeway to keep rates on hold this month, and if that trend persists, the Fed won’t be on the hook for the rest of the year,” said Jeffrey Roach, chief economist at LPL Financial. A rate hike is too likely.”

The mild CPI reading was good news for workers. Average hourly earnings, adjusted for inflation, rose 0.3% this month, the Bureau of Labor Statistics said in a separate version. During much of the inflation spike that began about two years ago, real incomes were negative and rose 0.2% on an annualized basis.

The consumer price report is characterized by a growing discrepancy between the core and headline figures. The All Items index usually leads the food and energy indicators, but that has not been the case recently.

The year-over-year difference between the two measures stems from surging gasoline prices at this point in 2022. Eventually, gas pump prices will exceed $5 a gallon, which has never happened before in the United States. Gasoline prices have fallen 19.7 percent over the past year, Tuesday’s BLS report showed.

However, food prices were still up 6.7 percent from a year ago. Home prices rose 8 percent and transportation services rose 10.2 percent, even as air fares fell 13.4 percent after surging early in the recovery.