Bank of Japan Governor Kazuo Ueda arrives in Tokyo for interviews with a small group of reporters on May 25, 2023.

Richard A. Brooks | AFP | Getty Images

Analysts are divided on the BOJ’s move after Japan’s core inflation ran above the central bank’s 2 percent target for 15 straight months.

Nicholas Smith, Japan strategist at CLSA, believes the Bank of Japan has been “caught off guard” on inflation.

Related investment news

“They see the Fed saying inflation is temporary and they look stupid because of it,” Smith told CNBC’s “Street Signs Asia.”

“They decided to ignore that and continue to forecast 1.8% inflation for the financial year. Inflation has been above 2% for 15 consecutive months.”

core of japan The consumer price index rose by 3.3% year-on-year The June growth rate was in line with expectations of economists polled by Reuters and was slightly higher than May’s 3.2 percent growth.

Core inflation in Japan removes the price of fresh food from the headline consumer price index. Headline inflation was 3.3% in June, up slightly from 3.2% in May.

Inflation data is key to the Bank of Japan’s monetary policy considerations ahead of next Friday’s meeting.

Barclays economist Tetsufumi Yamakawa said in a note that most markets still seem to view Japan’s price rise as “temporary” and attribute it to “cost push” rather than “demand pull”.

However, he sees the “increasing likelihood” that sustained inflation will become a reality, with the latest wage talks, the so-called “spring fight”, bringing about a surge in wages.

“We expect FY2024 ‘spring knife’ wage increases to be smaller than FY23, but project increases of around +3%, which is in line with the +2% price stability target,” Yamakawa wrote.

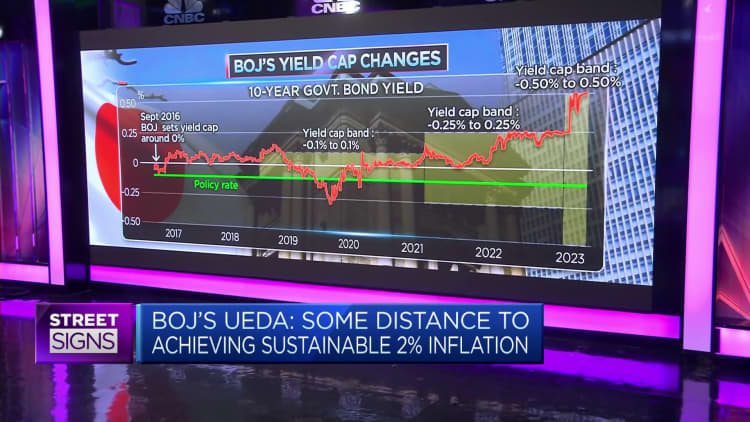

Changes in YCC’s stance

Given this, investors will be looking for signs that the Bank of Japan will change its stance on ultra-loose monetary policy, or more specifically, its “yield curve control” policy.

According to the YCC policy, the central bank sets the short-term interest rate target at -0.1%, the 10-year government bond yield is set at 0.5% around zero, and the goal is to maintain the inflation target at 2%.

However, Bank of Japan Governor Kazuo Ueda said In a recent Reuters report The Bank of Japan is likely to maintain an ultra-loose monetary policy for now, saying that “there is still a certain distance from the sustainable and stable realization of the central bank’s 2% inflation target.”

Smith believes it is “very likely” that the BOJ will change its stance on the YCC at its next central bank meeting next Friday.

Smith said so-called “core-to-core” inflation, which excludes fresh food and energy costs, “surged up” to 4.2% in June. That was the highest level since September 1981, he said, adding that “its own measure shows what they say is wrong.”

The main driver of inflation is food, combined with higher electricity prices, rising wages and a weaker yen, according to CLSA strategists. Noting that wages have also risen by the most in 30 years this year, Smith said Japan’s inflation could surprise ahead, driven by a spiraling wage-price spiral.

“If the BOJ does nothing, the yen will surge to 150 against the dollar,” he said. “We know from experience that intervention doesn’t work. Since 1990, I’ve seen $95 trillion worth of FX intervention, and the effects lasted hours, not days.”

Smith said the BOJ’s increasing bond purchases are just to maintain the YCC policy, noting that its bond purchases have accounted for 15.8% of Japan’s gross domestic product since early December.

Ueda said the BOJ has reached the limit of what it can do because it already owns a third of the bond market, he added. “Now that it has 55 per cent of the bond market, it’s starting to look like Looney Tunes.”

However, Yamakawa does not think the BOJ will change its monetary policy stance at its July monetary policy meeting. Instead, he predicts the central bank will roll out plans to phase out YCC at its October meeting, when the next quarterly outlook report will be published.