Nvidia, the California-based chip manufacturer, has surpassed expectations with its quarterly revenue forecast, thanks to the growing demand for its chips in the artificial intelligence (AI) sector. The company also announced a $25 billion share buyback plan, leading to a surge in its stock price after hours. Nvidia’s revenue forecast exceeded expectations by billions of dollars, demonstrating the continued growth of generative AI technologies, which heavily rely on Nvidia’s chips. The company’s share repurchases come as its stock has already tripled in value this year, making it the first trillion-dollar chip business and positioning it as the primary beneficiary of the AI boom.

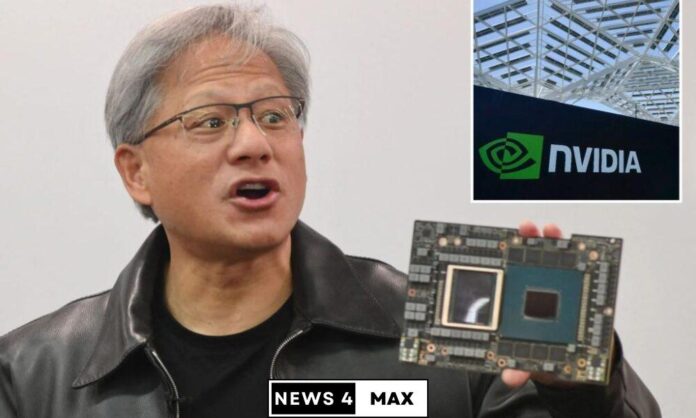

Industry analysts estimate that demand for Nvidia’s AI chips is surpassing supply by at least 50%, and this imbalance is expected to persist for several quarters. Jensen Huang, Nvidia’s CEO, acknowledged the global transition from general-purpose to accelerated computing and generative AI, affirming the company’s strong position in this market. Nvidia’s third-quarter revenue is projected to reach $16 billion, well above analysts’ forecasts.

Following the positive news, Nvidia’s stock jumped by 9.6% in after-hours trading, reaching an all-time high. Additionally, the company’s report had a positive ripple effect on other Big Tech stocks and AI-related companies, with Microsoft, Meta Platforms, and Palantir Technologies experiencing boosts in their stock prices.

Daniel Ives, an analyst at Wedbush Securities, described Nvidia’s results as a “drop the mic” moment that will likely impact the tech industry throughout the rest of the year. Various companies, including AI startups and major cloud services providers like Microsoft, are scrambling to secure more Nvidia chips. Chinese companies, in particular, are rushing to place orders to stock up on chips before potential US export restrictions are implemented.

Nvidia’s finance chief, Colette Kress, assured analysts that additional export restrictions on AI chip sales to China would not immediately impact the company’s results. However, she pointed out that such controls would harm the US industry’s ability to compete in one of the world’s largest markets, resulting in a permanent loss of opportunities.

The company’s data center business experienced significant growth, with revenue rising by 141% to $10.32 billion in the quarter ended July 30. This surpassed analyst estimates by more than $2 billion. Analysts also predict that Nvidia’s data center segment could generate up to $40 billion in revenue for its fiscal year 2025, driven by its AI chip dominance and related technologies such as software applications like OpenAI’s ChatGPT.

While Advanced Micro Devices is expected to gain some market share in the AI chip sector next year, analysts believe that Nvidia’s software has a considerable lead over its competitors. Nvidia’s chips are powering various AI applications, including Open AI’s ChatGPT.

Although sales of chips for personal computers and data centers have been weak in recent months, the demand for AI-related chips remains strong. Cloud computing businesses and startups are actively purchasing AI chips from Nvidia, as well as other companies like Broadcom and Marvell Technology. Analysts predict that AI-related spending will continue to grow at the expense of traditional server equipment.

In the second quarter, Nvidia’s gaming segment also saw positive growth, with revenue reaching $2.49 billion, surpassing analyst estimates. The company’s adjusted earnings per share were $2.70, exceeding estimates of $2.09.

For the current third quarter, Nvidia expects an adjusted gross margin of 72.5%, with a small margin of error. This forecast exceeds analysts’ average expectation of 70.4% gross margin.

As Nvidia continues to thrive in the AI chip market, it faces the challenge of meeting the rising demand by navigating supply chain hurdles and boosting production. The company has already increased its inventory commitments by 53% to $11.15 billion to secure long-term supply for its data center chips.