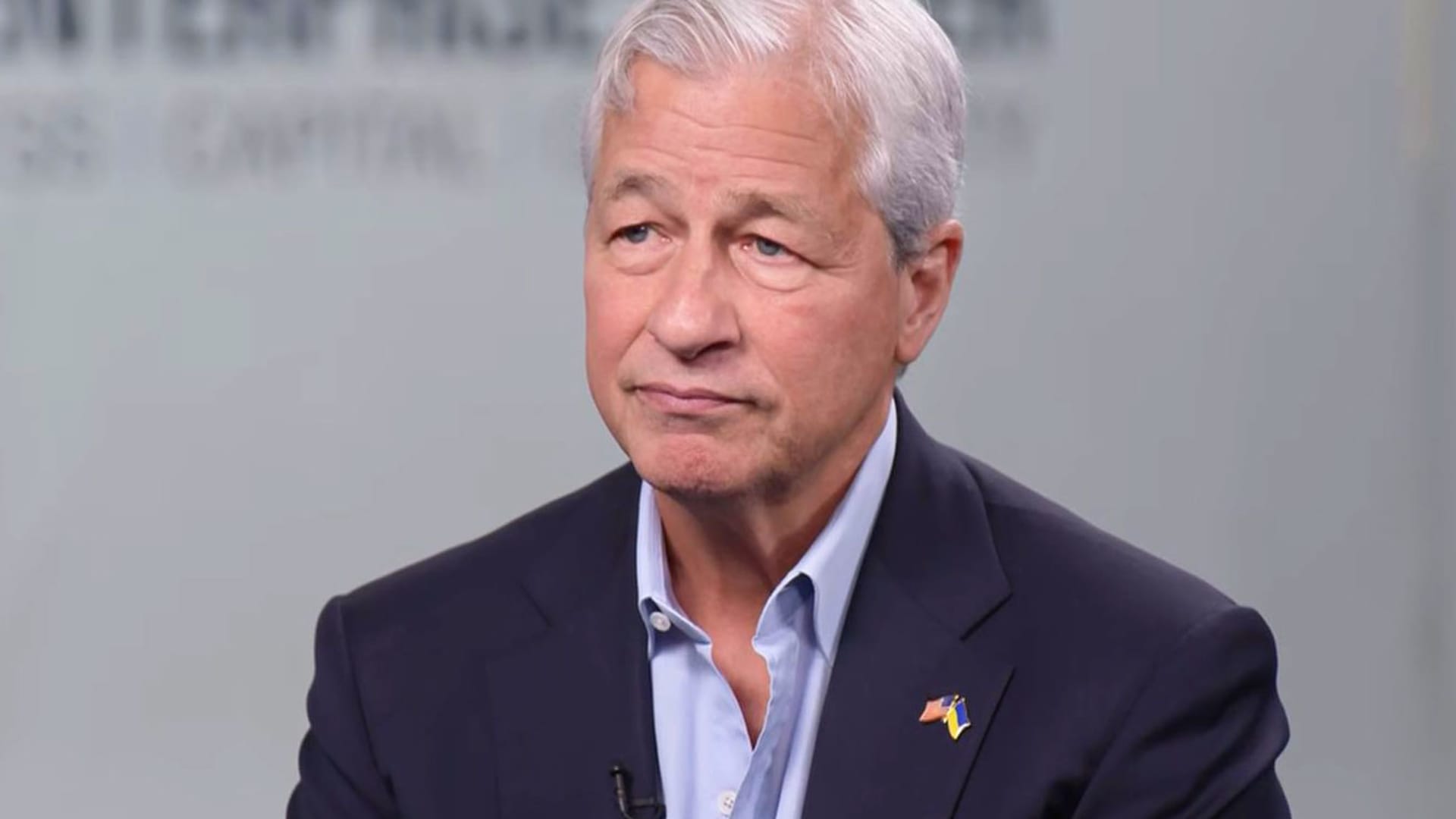

JPMorgan Chase CEO Jamie Dimon during an interview with Jim Cramer, February 23, 2023.

CNBC

Deposit runs have led to the failure of three U.S. banks this year, but another concern is surfacing.

Commercial real estate is the area most likely to pose problems for lenders, JPMorgan CEO Jamie Dimon told analysts on Monday.

“There’s always an offside,” Dimon said during a question-and-answer session at his bank’s investor conference. “In this case, the offside could be real estate. It would be certain locations, certain office properties, certain construction loans. It could be very isolated; it wouldn’t be every bank.”

U.S. banks have seen historically low loan defaults over the past few years, thanks to low interest rates and the flood of stimulus money unleashed during the Covid pandemic. But the Fed raised interest rates to fight inflation, which changed the game. Commercial buildings in some markets, including tech-centric San Francisco, could take a hit as remote workers hesitate to return to the office.

“There’s going to be a credit cycle; I think it’s going to be very normal,” with the exception of real estate, Dimon said.

For example, if unemployment rose sharply, credit card losses could spike to 6% or 7%, Dimon said. But that would still be below the 10 percent recorded during the 2008 crisis, he added.

Separately, Dimon said banks — especially the smaller ones that have been most affected by the sector’s recent turmoil — need to prepare for a rise in interest rates that is much higher than most expect.

“I think everyone should be prepared for interest rates to go up from now on,” up to 6% or 7%, Dimon said.

The Fed concluded last month that mismanagement of interest rate risk contributed to the collapse of Silicon Valley Bank earlier this year.

The industry has capitalized on potential losses and regulation by reining in its lending activity, he said.

“You’ve seen credit tighten because the easiest way for banks to preserve capital is not to make the next loan,” he said.