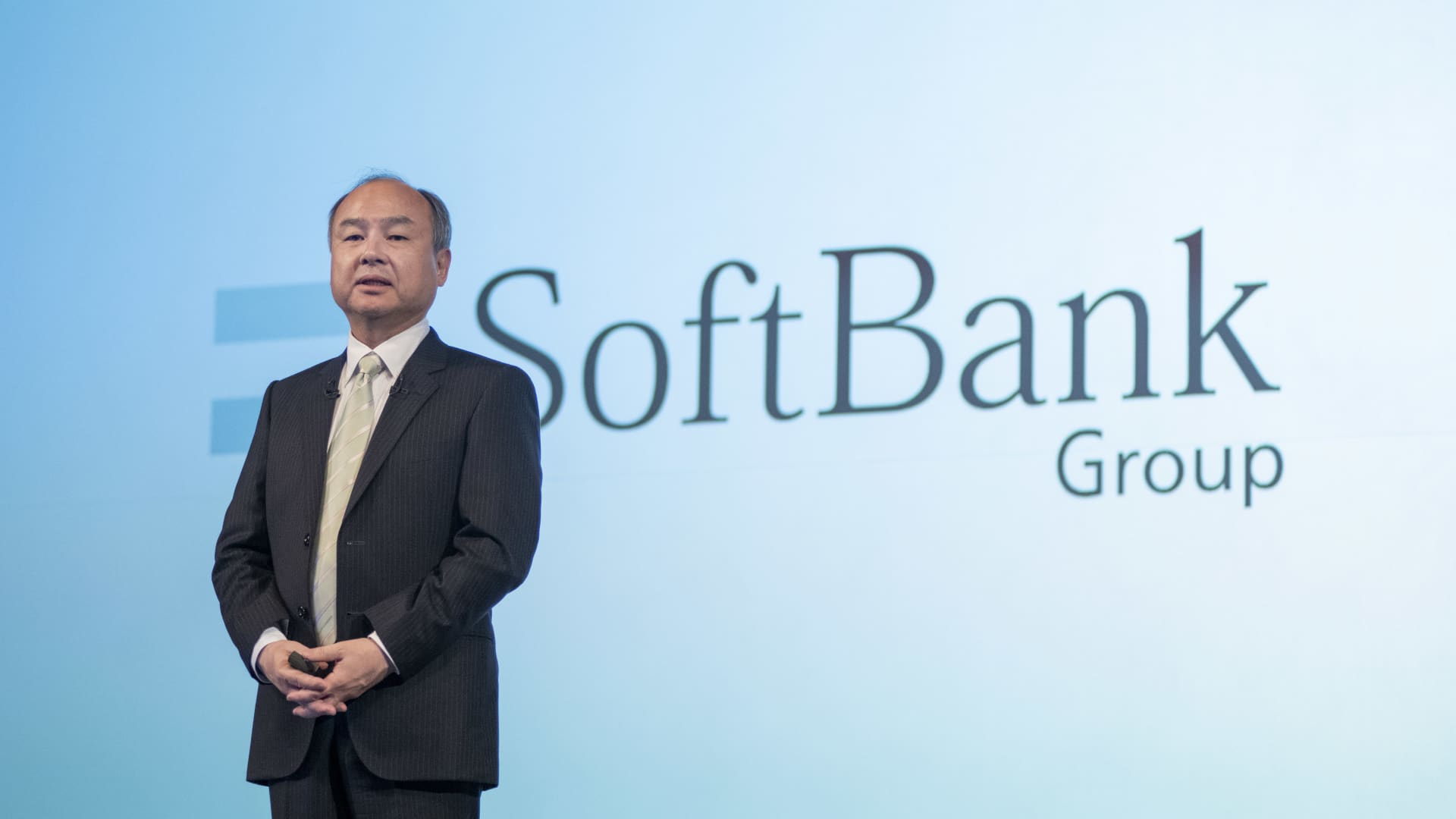

SoftBank Chief Executive Masayoshi Son has been weighing options for chipmaker Arm after Nvidia walked away from buying the company.

Alessandro Di Jomo | Nurphoto | Getty Images

softbank The sharp rebuke came to S&P Global Ratings on Wednesday after it downgraded the Japanese giant’s credit rating.

“Over the past year, our disciplined defensive financial management has strengthened our financial position in an unprecedented manner,” SoftBank said. “It is very regrettable that our financial soundness has not been properly assessed and we will continue our dialogue with S&P.”

S&P Global Ratings on Tuesday downgraded SoftBank to “BB” from “BB+” — a company it views as “speculative” or “junk” in its credit rating.

SoftBank shares closed down 2.3 percent in Tokyo on Wednesday.

Over the past few years, SoftBank has become one of the world’s largest tech investors, pouring billions of dollars into some of the biggest tech companies, including Uber, through its two Vision Funds. SoftBank primarily invests in private companies.

The Vision Fund unit posted a record 4.3 trillion yen ($3.1 billion) loss in the fiscal year ended March 31 as corporate valuations plummeted as rising interest rates around the world sent tech shares tumbling.

SoftBank has been cutting its stake in Chinese e-commerce alibaba, which has held for more than two decades and has made the Japanese company’s founder, Masayoshi Son, his fortune. The aim is to shore up SoftBank’s balance sheet as the company’s management has pledged to play a “defensive role” and be more cautious about its investment strategy.

Still, S&P Global Ratings believes SoftBank’s Vision Fund has significant exposure to private companies, which are more volatile, due to the sale of Alibaba shares listed in the U.S. and Hong Kong.

“Continued sales of shares in China-based Alibaba Group Holding Ltd. . The firm’s major investments in technology stocks have been in a long-term downturn.”

SoftBank argued that S&P did not take into account its cash position, which rose to 5.1 trillion yen in the fiscal year ended March 31, compared with 2.3 trillion yen in the same period in 2022.

“It is important to note that S&P’s assessment of the ratio of listed assets excludes cash and deposits etc. (5.1 trillion yen), which are the most liquid assets,” SoftBank said.

Arm listing comes into focus

SoftBank bought UK chip designer Arm in 2016 – last month Confidential application to list in the US

S&P noted that listing with Arm was a “positive” for SoftBank, but it didn’t factor the development into its assessment because the company’s timing and valuation remain “uncertain.”

SoftBank said it “strongly urges S&P to consider an upgrade following the completion of the proposed Arm IPO.”

S&P also noted that SoftBank’s goal of “disciplined financial management even in a difficult operating environment” will continue to “enhance the company’s credibility.”

Ultimately, the negatives outweighed the positives, the ratings agency said.

“As a result, we downgrade the company. Its portfolio volatility and increased asset risk are negative for the group. At the same time, financial management, high levels of cash and holdings of Arm shares that may go public are positive”