Stronger-than-expected U.S. inflation and a surge in consumer spending fueled global expectations for higher interest rates as forecasts for future monetary policy shifted rapidly.

Data on Friday showed the Fed’s preferred measure of inflation beat expectations in April, while U.S. consumer spending rose last month and new orders for durable goods unexpectedly rose.

The personal consumption expenditures price index, which measures how much people pay for goods and services, rose 0.4% month-on-month after rising 0.1% in March.

“We’ve been surprised by the upside in the inflation numbers and that’s a problem,” said Florian Ielpo, head of macro at Lombard Odier Investment Management.

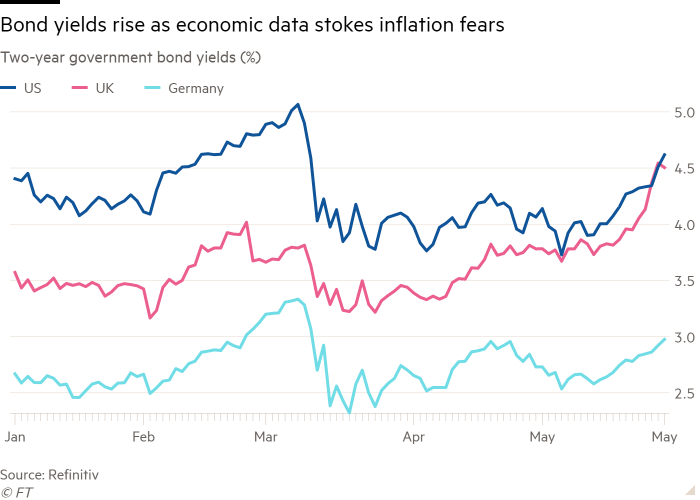

Short-term government debt yields in the U.S., U.K. and the euro zone have stopped falling and started rising again as investors shifted from bets on an economic slowdown to expecting higher interest rates in response to rising prices.

The shift marks a major change for fund managers and traders who have spent much of this year trying to predict when a streak of rate hikes will start to slow the economy, allowing the central bank to start cutting rates.

Futures markets are now pricing in a 37 percent chance of another rate hike in June, after previously pricing in a rate cut as the next step.

The two-year yield, which is particularly sensitive to investors’ interest rate expectations, has risen to 4.6% from a low of 3.7% earlier this month. Yields rise as prices fall.

In a further sign that the U.S. economy is still moving forward, inflation-adjusted personal consumption rose a flat 0.5% in April from March as spending on services such as insurance and health care picked up.

Orders for durable goods, which include washing machines, cars and airplanes, rose 1.1% from the previous month, above economists’ expectations for a 1% drop.

Progress in U.S. debt ceiling talks also pushed U.S. Treasury yields higher as White House negotiators sought to reach a deal with the House Republican leadership this weekend.

Yields also rose in Europe and the UK.

UK two-year gilt yields rose 0.6 percentage points this week to above 4.5%, the highest level since October. Equivalent German bond yields have risen to just under 3% from around 2.5% earlier this month.

Investors have been particularly jittery about high core inflation — a measure that strips out volatile food and energy prices — putting pressure on the central bank to raise rates further even at the risk of a recession.

“We’re certainly not out of the danger zone,” said Sonja Laud, chief investment officer at Legal & General Investment Management.

In a recent note, analysts at BlackRock said that most advanced economies “are grappling with a common problem . . . core inflation has proven more stubborn than expected and remains well above central bank’s 2% target”.

“We take this to mean that the central bank cannot cancel any anti-inflation rate hikes anytime soon,” they wrote.

Earlier this month, markets expected the ECB to raise rates again to 3.5%, but futures markets now expect the rate to peak at 3.7% in October.

“Europe is actually second only to the U.S. in the economic cycle, so we think the ECB has scope for further (rate hikes),” said Mark Dowding, chief investment officer at BlueBay Asset Management.

In the UK, data this week showed core inflation rose 6.8% in the year to April, faster than economists had forecast.

Imogen Bachra, head of UK rates strategy at NatWest, called the data a “game changer” for rates. The swap market is pricing in a peak Bank of England rate of 5.5% by November, up from 4.9% a week ago and well above the current 4.5%.