Decades ago, Carl Icahn gained insight from reading the works of American novelist Theodore Dreiser. The billionaire investor was drawn to two of Dreiser’s novels, financier and titanwhich chronicles the rise of industrialist Frank Copperwood.

In a decisive financial standoff, Copperwood’s opponents conspired to collect his massive personal debts through the bank. But what they didn’t know was that Cowperwood had a large reserve of assets “that could be withdrawn and mortgaged.” If it were deployed, Dreiser wrote, “these people should finally see how powerful and how safe he is”. Cowperwood prevailed, and Icahn said he learned an important lesson: Always have a cash “war chest.”

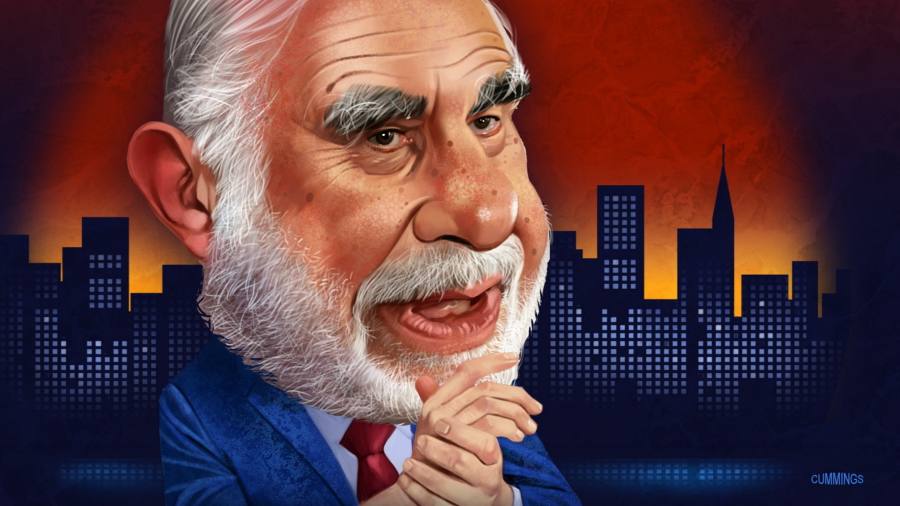

The 87-year-old is known for orchestrating shareholder fights over the decades at companies including Texaco, Trans World Airlines, Apple and McDonald’s. These struggles have reshaped U.S. financial markets by changing how companies operate, steering their management in the interests of big shareholders like Icahn.

For nearly half a century, as long as his name is mentioned, business executives will be terrified, and the market will also be shaken. But much of Icahn’s power comes from an obscure, thinly traded public body called Icahn Enterprises, which is largely unvetted.

This month, Icahn was mobbed by a skeptic named Nathan Anderson, who revealed in a report published by his firm Hindenburg Research that investors traded for their holdings. The huge debt owed by Icahn Enterprises stock. The revelation exposed a surprising vulnerability of one of the world’s wealthiest financiers. Icahn has vowed to “fight back,” but his plans to defend the empire remain a mystery.

In recent years, Icahn has made increasingly bigger bets on fast-rising markets to protect his investments from future crashes. Instead of creating a contingency reserve, these transactions resulted in losses of nearly $9 billion. Confronted with those losses last week, a cautious Icahn admitted: “Maybe I made a mistake in not sticking to my advice in recent years.”

This predicament has alarmed many in the upper echelons of Wall Street. “It’s one of those moments in a crisis where you say, ‘Oh my God, everything I thought about somebody was wrong,'” said the head of a major financial firm.

The harshest assessment came from billionaire investor Bill Ackman, with whom Icahn sparred in a storied fight over the fate of the multi-level marketing company. “Icahn’s favorite Wall Street motto is: ‘If you want a friend, get a dog,'” Ackman wrote on Twitter. “Icahn has made many enemies throughout his storied career. I don’t know if he has any real friends. He could use one here.

Born in 1936 to a family of schoolteachers, Icahn grew up in the working-class neighborhood of Far Rockaway, Queens, New York. After graduating from a local public high school, he earned a degree in philosophy from Princeton University and supported himself on his poker winnings.

He briefly attended medical school, but dropped out and joined the military before settling down to become a stockbroker. In the late 1960s, a wealthy uncle financed Icahn’s purchase of a seat on the New York Stock Exchange, where he became an expert in “risk arbitrage,” betting on prospective corporate mergers.

Icahn entered the public consciousness in the 1980s, when he won control of TWA with financing from junk-bond king Michael Milken. He ruthlessly sold TWA assets for cash and fought unions, earning him a reputation as a “corporate raider.” The episode inspired Gordon Gekko, the character in the film wall street.

In recent years, Icahn, who divorced his first wife and married his assistant Gail, moved his company to Miami from a skyscraper overlooking Manhattan’s Central Park. He also worked more closely with his adult children, Brett and Michelle.

Brett helped shape successful bets on Apple and Netflix and was named his father’s eventual successor. Michelle’s work at the Humane Society inspired Icahn to launch an unsuccessful campaign against McDonald’s treatment of livestock.

The attack on Icahn comes as he continues to battle a company he sees as mismanaged. On Thursday, he drew a draw in a war against Illumina, a company that makes machines that sequence the human genome. Icahn accused Illumina’s management of reckless acquisitions and demanded that its shareholders give his nominees three board seats. He was able to oust Illumina’s seat, but failed to win the other two seats that would have helped him oust its CEO. The result underscores his enduring influence. But he was in uncharted territory.

Shares of Icahn Enterprises have plunged more than 30% this week, wiping out more than half of the company’s market value. It cost Icahn billions of dollars and made the “margin call” threat from his lenders more immediate.

Whether he wins will likely depend on what he says he learned from Dreiser’s Copperwood decades ago. Icahn told the Financial Times last week that billions of dollars were sitting outside his bus. If so, War Chest will give him an extra hand to play.

antoine.gara@ft.com

Additional reporting by James Fontanella-Khan