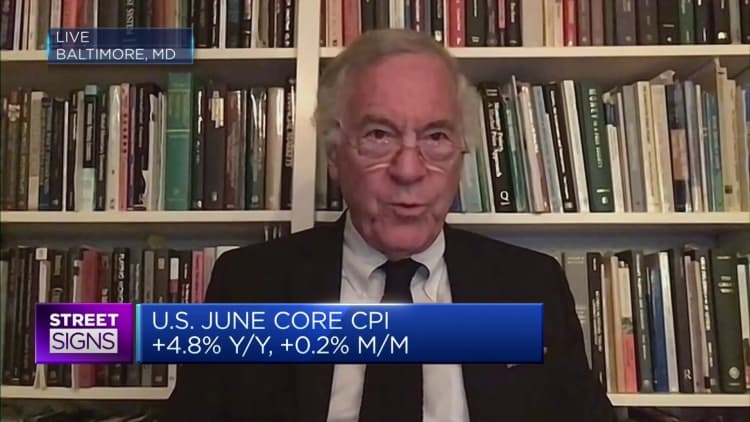

Veteran economist Steve Hanke said the US no longer has an inflation problem.

“I think the inflation story is history. One of the reasons for this is that the U.S. money supply contracted -4% year-over-year,” said Hanke, a professor of applied economics at Johns Hopkins University. told CNBC’s “Street Signs Asia” on Thursday.

“We haven’t seen that since 1938,” Hanke said. “A change in the money supply causes a change in the price index and inflation.”

Prices displayed at a New York City grocery store on February 1, 2023.

Leonardo Munoz | Corbis News | Getty Images

U.S. inflation in June came in below expectations at 3 percent on Wednesday, the smallest year-on-year increase in two years. The core consumer price index, which excludes volatile food and energy prices, rose 4.8 percent year-on-year and 0.2 percent month-on-month.

The latest data may give the central bank some leeway as it adjusts the direction of interest rate policy.

The U.S. producer price index is due later on Thursday. If it also shows lower prices, it could further influence the Fed’s decision to end its rate hike cycle as soon as possible.

Traders are betting there is a 92.4% chance the Fed will keep rates on hold at its July meeting, according to Fed data CME Group Fed Watch tool.

“When inflation is rampant, first the producer price index shoots up, then the consumer price index shoots up. Finally the core goes up like a snail,” Hanke said.

Forget all the hype we’ve been hearing – the Fed chair has a tough problem, it’s going to be a long game, things are tough, etc. Things don’t stick.

steve hank

Professor at Johns Hopkins University

“Right now, we’ve turned things around and the producer price index is falling like a rock. The consumer price index is also falling like a rock. And the core index is far behind,” he said, adding: “We just want them to continue Put quantitative tightening on and all of these will come down.”

Central bank policymakers tend to focus more on core inflation, which remains well above the Fed’s 2 percent annual target.

But Hanke noted that if the Fed continues to “keep doing what they’re doing,” it can get to “the 2% range” very quickly.

“Forget all the hype we’ve heard — the Fed chair has a tough problem, it’s going to be a long fight, things are tough, etc. Things aren’t tough,” the professor noted.

— CNBC’s Jeff Cox contributed to this article